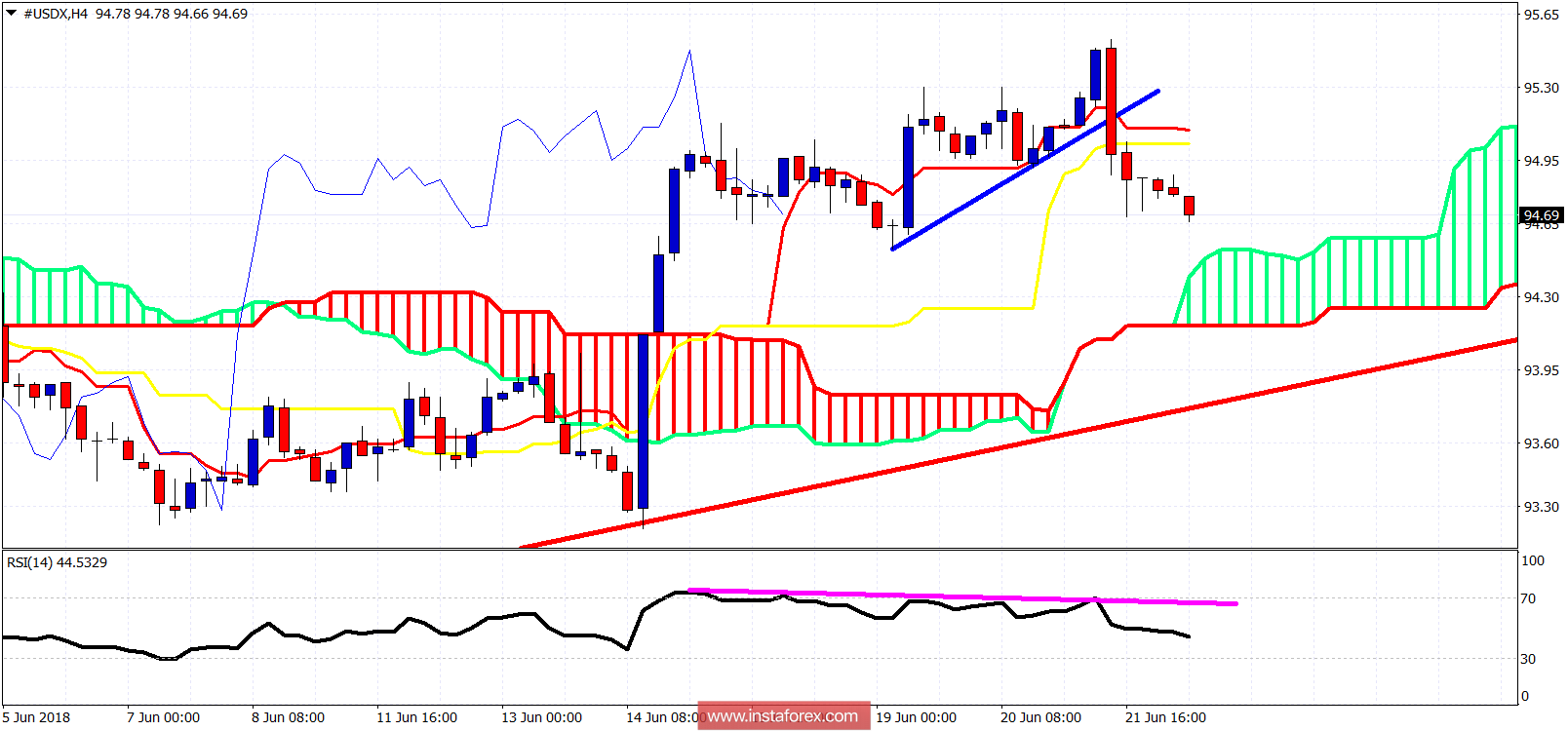

The Dollar index as expected has given a bearish signal. Our warnings to bulls that the new highs were not confirmed by the RSI came the same day when we saw price break below short-term support. The Dollar index could very well have topped.

Red line -medium-term support

The Dollar index has broken below the short-term support trend line and below both the kijun- and tenkan-sen indicators. This is a bearish reversal sign. Price could pull back towards 94-93.60 area where is the important medium-term support. For a long-term top to be in, the Dollar index should continue lower below 93.60. We remain bearish the index after yesterday's reversal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română