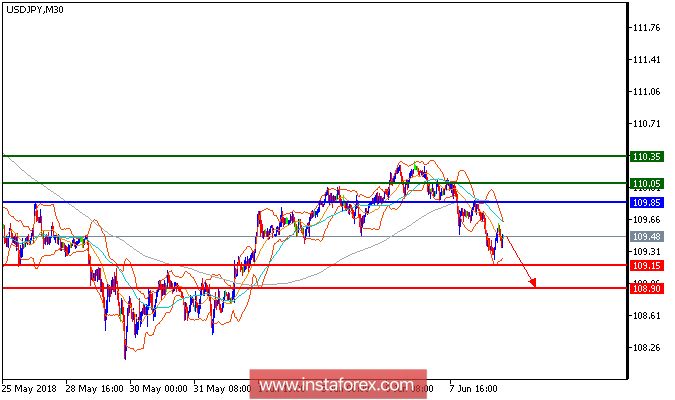

USD/JPY is expected to trade with a bearish outlook. The pair retreated and broke below its 20-period and 50-period moving averages. The relative strength index is heading downward. The key resistance at 109.85 should maintain the selling pressure. Hence, as long as 109.85 holds on the upside, look for a further drop with targets at 109.15 and 108.90 in extension.

Fundamental Overview: U.S. wholesalers restocked at a modest pace in April, according to a report released by the Commerce Department earlier today. Wholesale inventories rose a seasonally adjusted 0.1% in April from a month earlier, which exceeded the flat reading economists surveyed by The Wall Street Journal had expected. In March, inventories increased 0.2%. April's rise came after change in private inventories contributed 0.13 percentage point to the revised 2.2% first-quarter growth rate for gross domestic product.

Chart Explanation: The black line shows the pivot point. Currently, the price is above the pivot point which is a signal for long positions. If it remains below the pivot point, it will indicate short positions. The red lines show the support levels, while the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 110.05, 110.30, 110.55

Support levels: 109.15, 108.90, 108.45

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română