Daily Outlook

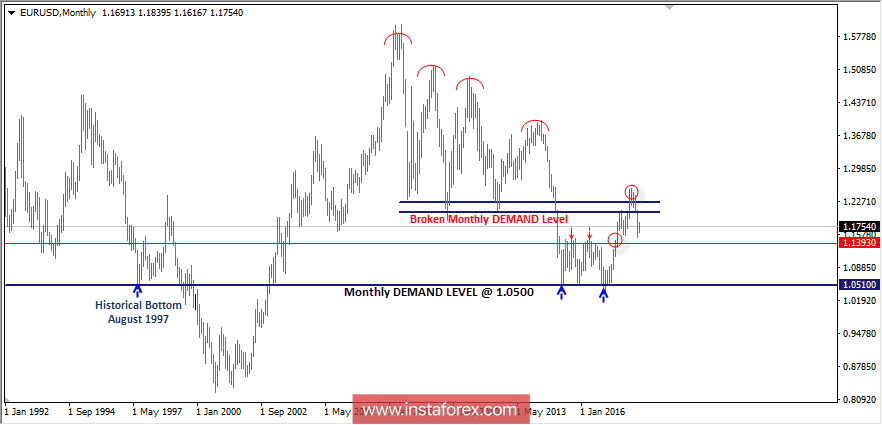

The short-term outlook turns to become bearish as long as the EUR/USD pair keeps trading below the broken uptrend as well as the lower limit of the depicted consolidation range remains broken.

Bearish persistence below the price level of 1.2200 allowed further bearish decline towards the price levels of 1.1990 and 1.1880.

The price zone (1.1850-1.1750) failed to offer sufficient bullish demand when a descending high was established around the price level of 1.1980.

The EUR/USD bulls failed to pursue towards higher bullish targets. Instead, significant bearish pressure is being applied since then.

As bearish momentum dominates, bearish persistence below 1.1700-1.1750 (zone of previous daily lows) was maintained to enhance further bearish decline towards 1.1520 (the upper limit of the depicted demand zone).

The price zone (1.1420-1.1520) stood as a prominent Demand zone where the current bullish pullback was established on May 30.

Conservative traders can wait for bullish pullback towards the current price levels (1.1800-1.1850) for a valid SELL entry. S/L should be placed above 1.1530.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română