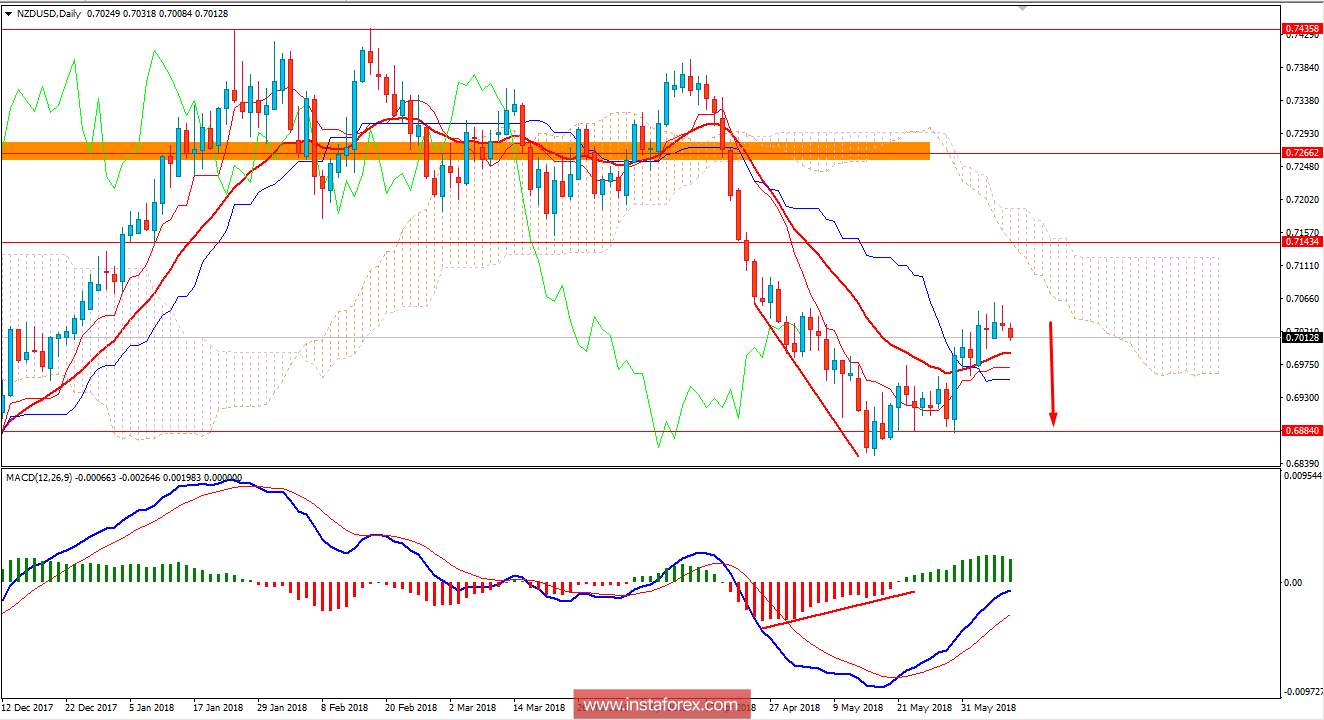

NZD/USD has been bullish recently after bouncing off the 0.6850 support area which is expected to be retested soon in the coming days. Despite having mixed economic reports, NZD gained good momentum over USD which is currently expected to be engulfed by USD in the coming days.

Recently, the NZD ANZ Commodity Prices report was published with an increase to 1.5% from the previous value of 1.0% which lead the currency to gain certain momentum but could not sustain it longer in the process as USD has been quite better with the results in comparison.

Recently, the US ISM Non-Manufacturing PMI report was published with an increase to 58.6 from the previous figure of 56.8 and the JOLTS Job Opening report was also published with an increase to 6.70M from the previous figure of 6.63M. The positive economic report helped the currency counter the NZD momentum which was being built for a month. Today, the US Final Wholesale Inventories report is going to be published which is expected to be unchanged at 0.0%. Moreover, today due to G7 Meetings, USD is expected to be quite volatile with the gains in the process.

As of the current scenario, USD is expected to take the lead against NZD in the coming days which can reult in further bearish pressure in the process. Until NZD comes up with better economic reports to support its gains, USD is expected to continue the pressure further in the future.

Now let us look at the technical view. The price is currently quite bearish with the gains after rejecting certain bullish pressures along the way with daily close. After bouncing off the 0.6850 area, current momentum is indicating certain bearish pressure to be observed in the coming days which is expected to push the price lower towards 0.6850 to retest again in the future. As the price remains below 0.7150 area with a daily close, the bearish bias is expected to continue further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română