EUR/JPY has been quite impulsive with the bullish momentum recently which is expected to continue its bearish trend pressure after certain correction along the way. Despite the recent JPY positive economic reports, certain EUR gain over JPY was quite impressive.

Recent EUR worse economic report was expected to be a setback for the currency but that did not quite affect the bullish gain in the pair. Today EUR Spanish Services PMI report is going to be published which is expected to increase to 56.4 from the previous figure of 55.6, Italian Services PMI report is expected to increase to 52.9 from the previous figure of 52.6, French Final Services PMI report is expected to be unchanged at 54.3, German Final Services PMI report is expected to be unchanged at 52.1 and EUR Final Services PMI report is also expected to be unchanged at 53.9. Moreover, EUR Retail Sales report is expected to increase to 0.5% from the previous value of 0.1%.

On the JPY side, recently a Monetary Base report was published with an increase of 8.1% from the previous value of 7.8% which was expected to decrease to 7.4%. Today JPY Household Spending report is going to be published which is expected to increase to 0.8% from the previous value of -0.7%.

As of the current scenario, JPY has been quite positive with the economic reports but could not quite establish a proper momentum to gain over EUR in the process. Though certain EUR economic reports are going to be published today indecisive result on the EUR side might lead to certain corrections in the pair. The long-term bias is still bearish but the certain correction may be expected due to upcoming EUR indecisive economic reports yet to be published.

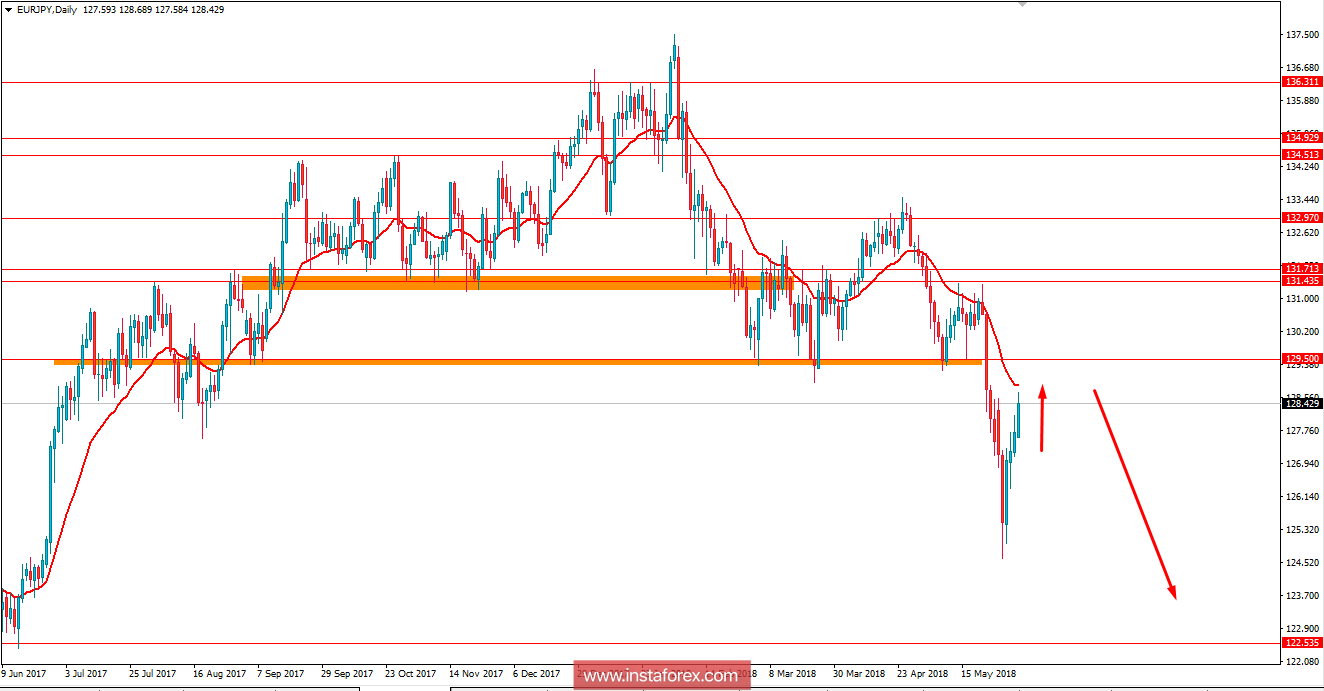

Now let us look at the technical view. The price is currently quite impulsive with the bullish gains which are expected to push higher towards the dynamic level of 20 EMA and 129.50 area before showing any signs of bearish pressure in the pair. The long-term trend is still bearish and certain bullish pressure in the pair is quite expected as the breakout below 129.50 did not have a required pullback along the way. As of the current structure, the price is expected to bounce back off the 129.50 area with a daily close which is expected to push the price much lower towards 122.50 area in the coming days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română