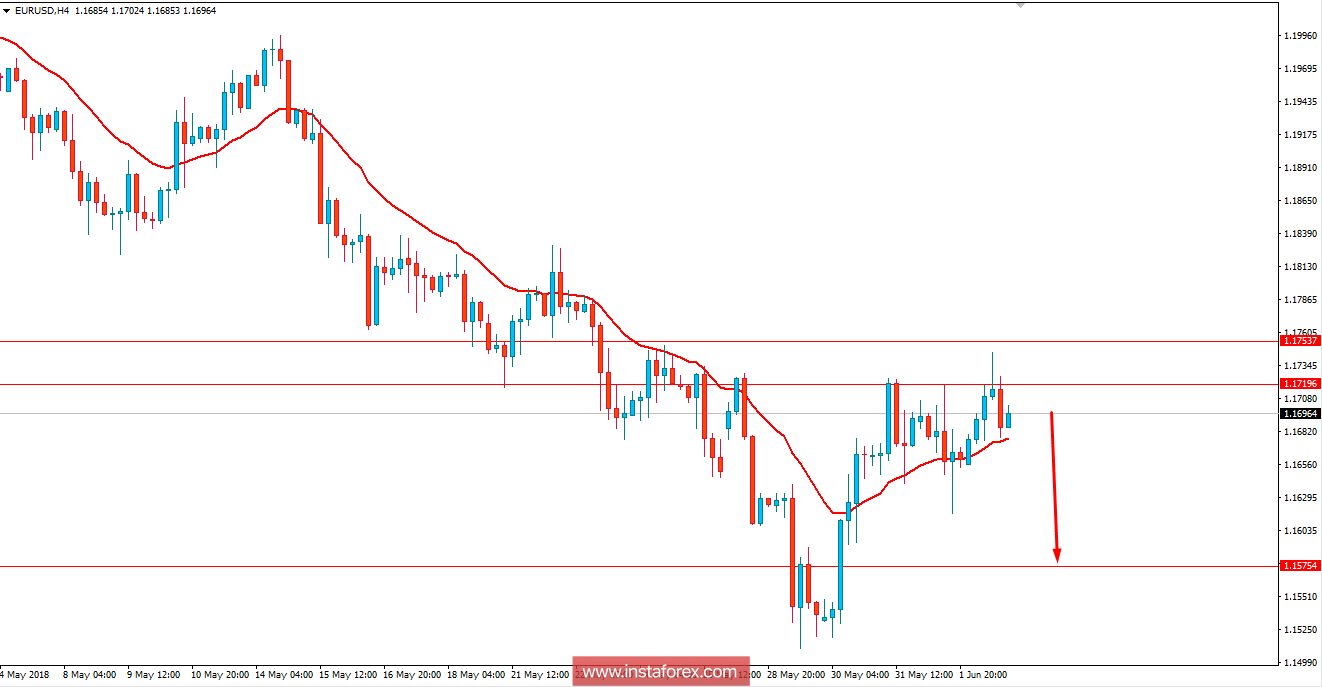

EUR/USD struggled its way towards 1.1720 area from where it is currently rejecting with a daily close which is expected to push the price much lower in the coming days. USD has been the dominant currency in the pair recently, whereas certain bullish pressure in the process is expected to be a part of the trend continuation retracement.

Recently published USD NFP, Average Hourly Earnings and Unemployment Rate report was quite positive which did not quite help the USD as it should be in the current market situation. Today USD Final Services PMI report is going to be published which is expected to be unchanged at 55.7, ISM Non-Manufacturing PMI report is expected to increase to 57.9 from the previous figure of 56.8, JOLTS Job Opening is expected to decrease to 6.49M from the previous figure of 6.55M and IBD/TIPP Economic Optimism is expected to increase to 54.2 from the previous figure of 53.6.

On the other hand, recent EUR worse economic report was quite a setback for the currency for which recent bullish rejection is assumed as the outcome. Today EUR Spanish Services PMI report is going to be published which is expected to increase to 56.4 from the previous figure of 55.6, Italian Services PMI report is expected to increase to 52.9 from the previous figure of 52.6, French Final Services PMI report is expected to be unchanged at 54.3, German Final Services PMI report is expected to be unchanged at 52.1 and EUR Final Services PMI report is also expected to be unchanged at 53.9. Moreover, EUR Retail Sales report is expected to increase to 0.5% from the previous value of 0.1%.

As of the current scenario, USD economic reports are quite optimistic in comparison to indecisive EUR economic reports forecasts. EUR has failed to sustain the momentum it recently gained against USD for which upcoming momentum and sentiment is expected to be in favor of USD in the coming days as the recent Employment report was quite positive and better than the expectation.

Now let us look at the technical view. The price is currently residing below 1.1720 area after rejecting with a strong bearish pressure. Though the price is currently residing above the dynamic level of 20 EMA in the process the bearish bias is still quite strong which is expected to push the price lower towards 1.1500-50 support area in the coming days. As the price remains below 1.1720-50 area, the bearish bias is expected to continue further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română