The Bank of Canada kept interest rates at the current level (1.25%), but the prospects for future tightening were outlined in a more pronounced language. The Bank of Canada removed "cautious" from the monetary policy statement, suggesting a slightly less data-dependent approach to policy normalization. It means the July interest rate hike might be almost certain and it was somewhat confirmed in this passage from the BoC Monetary Policy Statement: "This should lead the market to price in a July hike with more conviction." Another very interesting quote from the statement: "Furthermore, clarification of the reasoning behind the change will likely come from BOC officials ahead of the July meeting, which could provide further hawkish surprises" might be seen as one more confirmation of a very possible interest rate hike in June.

Considering slightly worse data and considerable uncertainty regarding the future of the NAFTA agreement, this should be interpreted in the categories of a big surprise.

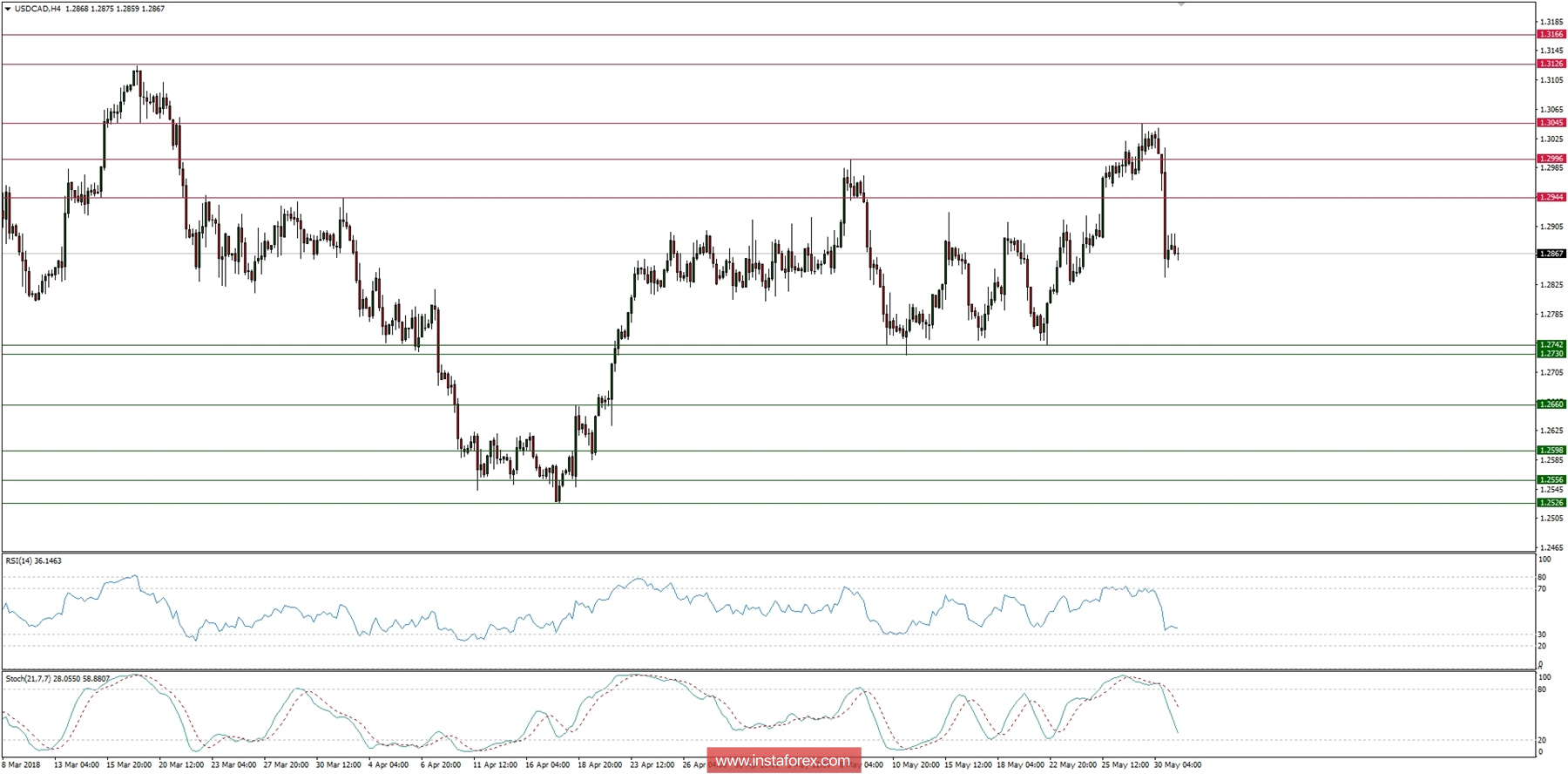

Let's now take a look at the USD/CAD technical picture at the H4 time frame. In the initial reaction, the price of USD/CAD drops from 1.3045 to 1.2944 and this move is being continued further. Currently, the price has broken below all of the intraday supports and it might be heading towards the next technical support at the level of 1.2742. Any violation of the level of 1.2730 would indicate the bears have now a full control over the market and the key technical support at the level of 1.2526 might be challenged soon.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română