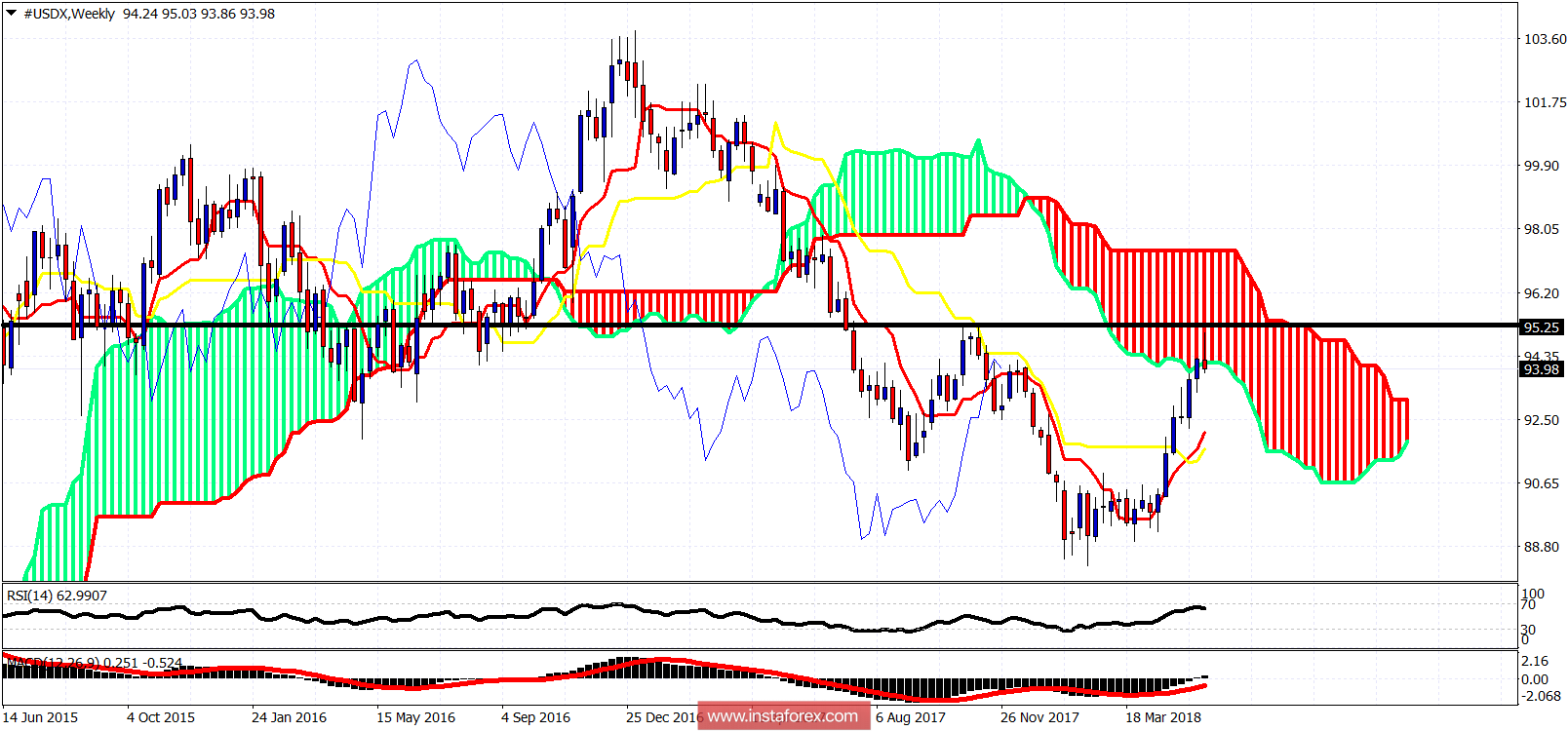

The US dollar index is breaking below 94 and shows signs of rejection at the Weekly Kumo (cloud) resistance. This justifies a pullback towards 92. This is not the time to be buying dollar but if you are bullish, you'd better wait for a pullback. I prefer to be short on the dollar.

Black line - horizontal resistance

The Dollar index reached the previous high where the black horizontal line is drawn. There was a confluence of previous high and cloud resistance at that area and bulls got rejected at that area. I believe the entire move from the 2018 lows to 95.20 is complete and we should see a resumption of the down trend in the US dollar index. The important weekly support is at 92. A break below it will open the way for new 2018 lows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română