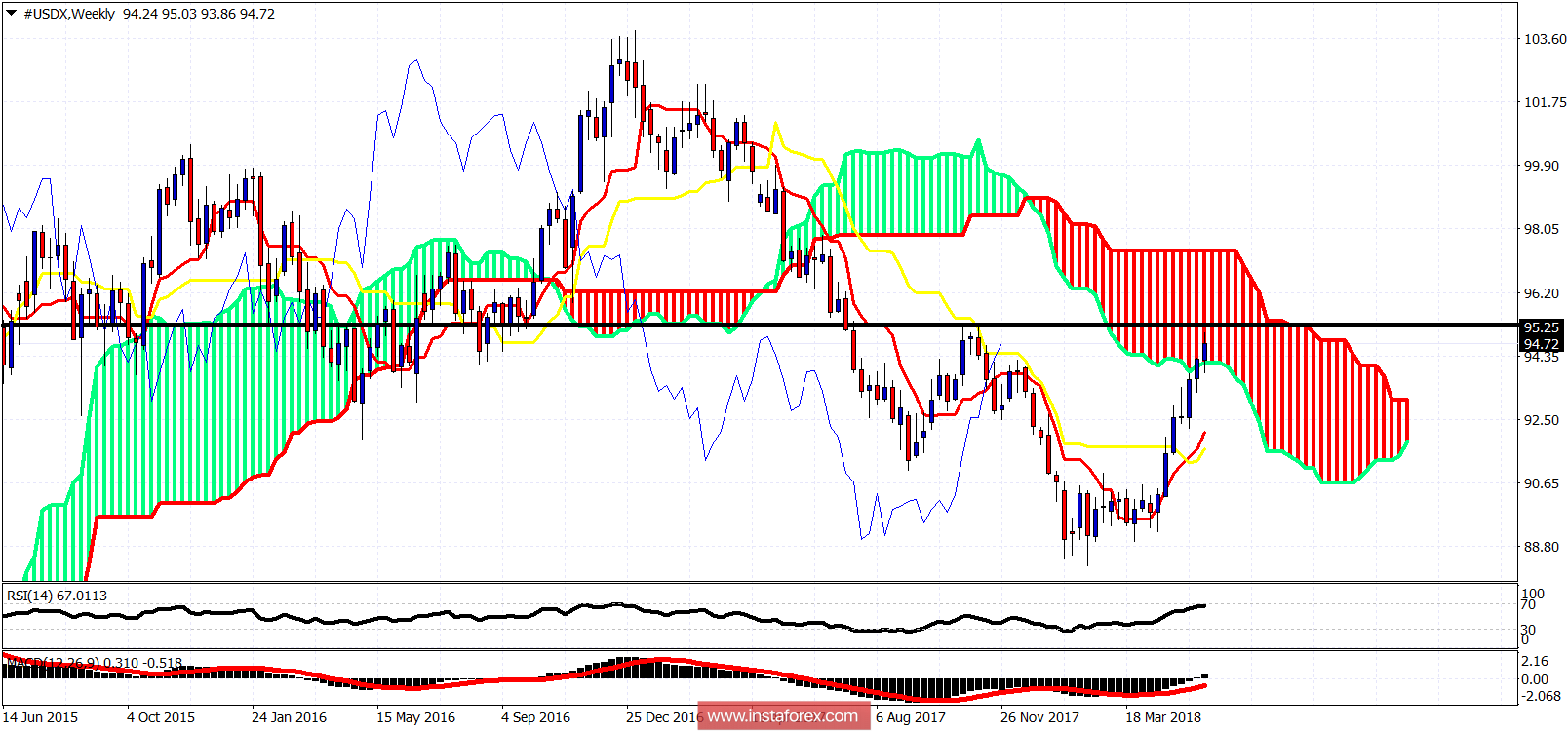

The Dollar index has reached the October 2017 highs and the weekly Kumo (cloud). This is a strong resistance area that justifies a pull back that is long overdue for the Dollar.

Black line - horizontal resistance

The Dollar index is in a short-term bullish trend. Price is above both the tankan- and kijun-sen indicators. The weekly candle has just entered inside the weekly Kumo. Now trading around 94.70, a weekly close below 94.15 will signal that a rejection has happened and a reversal is starting. If the weekly candle manages to hold above 94.20 we could see more upside although this is the least likely scenario for me. As long as price is above 92, I believe longer-term bulls will be safe. Bears need to break this level in order to regain full control of the trend again.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română