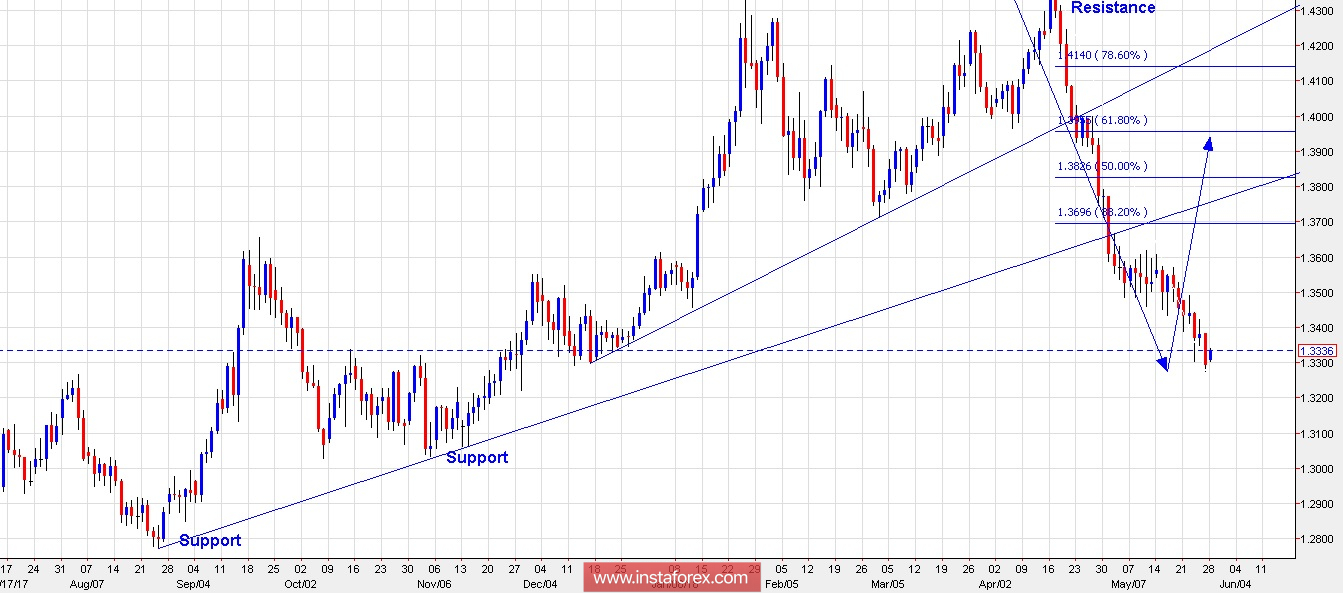

Technical outlook:

The GBP/USD daily chart might be already suggesting that the drop from 1.4360/70 levels has either completed or is about to complete its first leg at a larger degree. If you notice, the pair is producing a HARAMI candlestick pattern for now on the daily charts. This is a potential reversal pattern and indicates that price could turn bullish from here. If this holds true, the pair has an upside potential through 1.3700 levels at least and upto 1.4000 levels, which is fibonacci 0.618 resistance level as seen here. In terms of wave counts as well, an impulsive drop looks to be complete or near completion from 1.4360/70 levels and if that holds good, we should see a 3 wave counter trend rally soon, which could take prices higher up to 1.4000 levels in the next few weeks. On the flip side if GBP/USD drops below 1.3275 levels, the next support comes in between 1.3000/3100 levels.

Trading plan:

Aggressive traders may look to go long either from here or from 1.3000/3100 levels; while conservative traders may remain aside and look to sell on rallies.

Fundamental outlook:

There are no major events lined up for today.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română