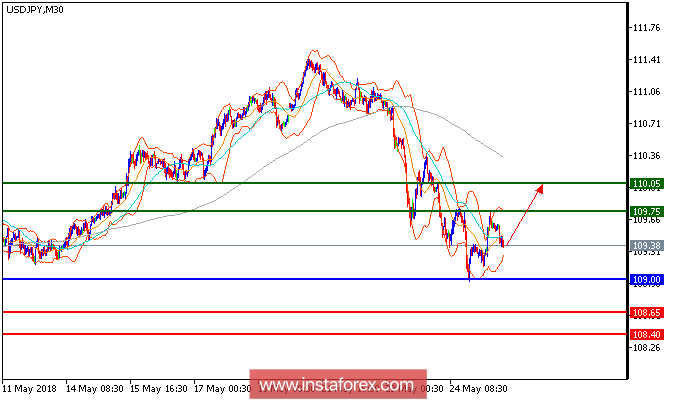

USD/JPY is expected to continue its rebound. The pair is rebounding above the key support at 109, which should maintain the buying interest. The golden cross between the 20-period and 50-period moving averages has been identified, indicating the bullish reversal. The relative strength index is bullish above its neutrality level at 50. Therefore, as long as 109.75 is not broken, look for the advance with targets at 109.75 and 110.05 in extension.

Fundamentals:

Sales of previously owned U.S. homes declined in April, as inventory shortages and rising prices weigh on the market and higher mortgage rates begin to pose a threat to demand for the first time in years. Existing-home sales fell 2.5% in April from the prior month to a seasonally adjusted annual rate of 5.46 million, the National Association of Realtors said Thursday. Compared with a year earlier, sales in April were down 1.4% -- the second consecutive month sales declined on an annual basis. Economists still expect existing home sales to edge up slightly this year, buoyed by economic growth. The Federal Reserve has signaled it will raise short-term rates three to four times this year and potentially three times next year, which could make a bigger impact going into next year. Traders are looking for today's Core durable goods order due to release at 13:30 GMT it is forecast to increase by 0.5% as compared to previous increase of 0.1%. Traders should also expect more volatility in market at 14:20 GMT, as Fed Chairman Powell will speak at that time.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot point indicates a short position. The red lines show the support levels, and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, stop loss at 109.00, take profit at 109.75.

Resistance levels: 109.75, 110.05, and 110.50

Support levels: 108.65, 108.40, and 108.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română