Daily Outlook

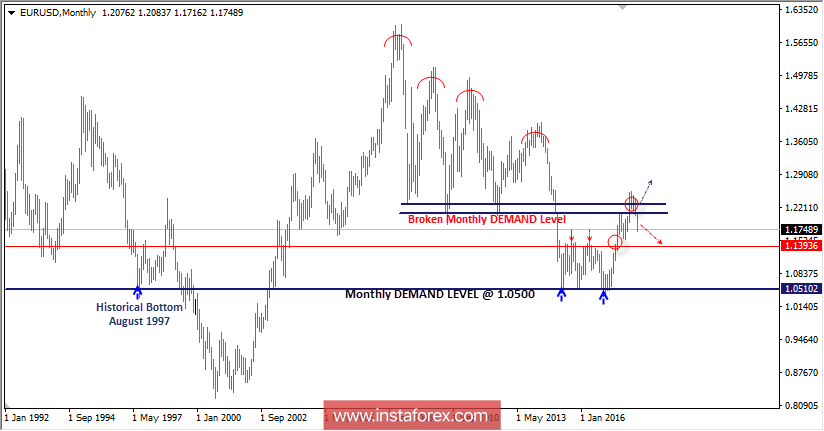

The EUR/USD pair had been trapped between the price levels of 1.2200 and 1.2500 until bearish breakout occured recently.

Significant signs of bearish reversal were manifested around the price levels of 1.2400.This was manifested in the bearish engulfing daily candlestick of April 20.

The short-term outlook turns to become bearish as long as the EUR/USD pair keeps trading below the broken uptrend as well as the lower limit of the depicted consolidation range remains broken.

Bearish persistence below the price level of 1.2200 allowed further bearish decline towards the price levels of 1.1990 and 1.1880.

As mentioned, the price zone (1.1850-1.1750) once offered significant bullish rejection and a short-term bullish pullback for intraday traders.

However, a recent descending high was established around the price level of 1.1990 as the EUR/USD bulls failed to pursue towards higher bullish targets. This enhances the bearish scenario of the market.

If bearish momentum dominates, bearish persistence below 1.1700-1.1750 (zone of previous daily lows) will be needed to enhance further bearish decline towards 1.1400 (the previously mentioned monthly key-level).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română