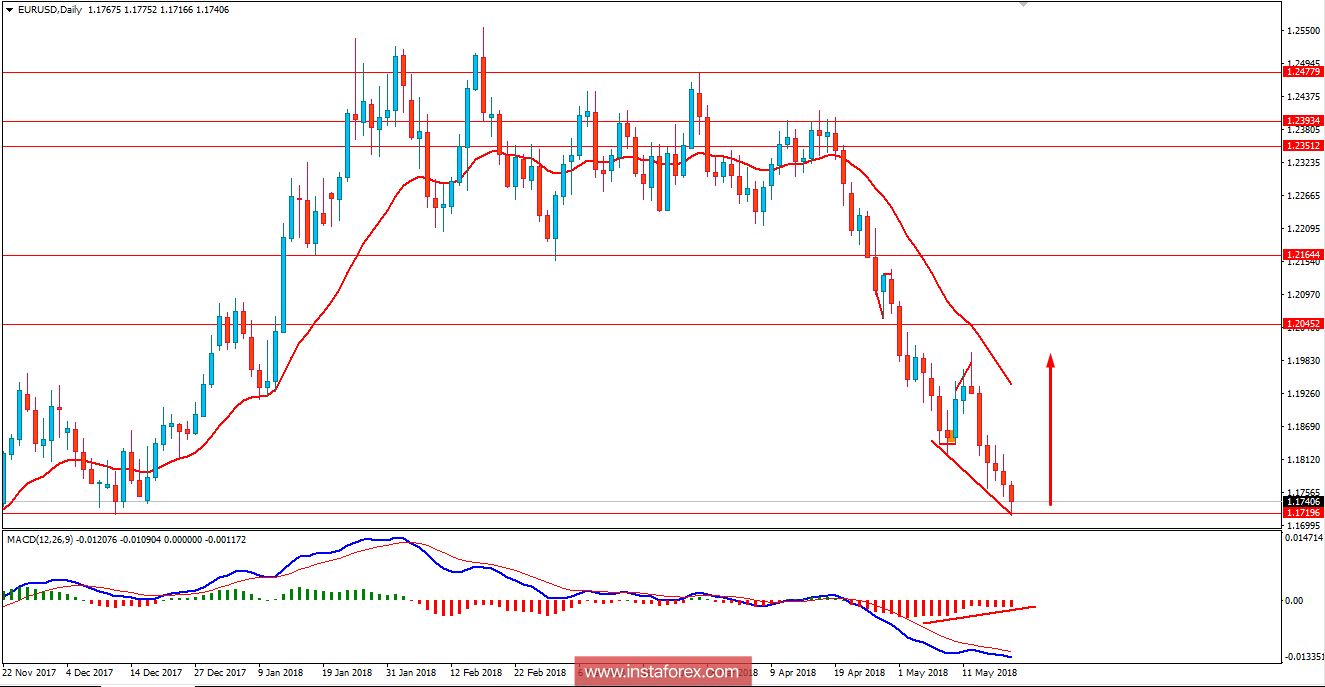

EUR/USD has been quite impulsive and non-volatile with the bearish gains recently which lead the price to reside at the edge of the 1.1700-20 support area today. USD has been the dominant currency in the pair for a certain period of time where EUR was struggling with the weak economic reports in the process.

Today, due to observance of Whit Monday, there is no impactful EUR economic report or event to be held, but this week, on Thursday, ECB Monetary Policy Meeting Accounts will be held which is expected to inject some volatility in the market in favor of EUR gains in the coming days.

On the other hand, this week, Fed Chair Powell is going to speak about the upcoming interest rate and inflation rate decision which is expected to favor USD in the coming days. Since 2015, there has been 6 times rate hikes in the US where the trend is expected to continue throughout 2018 as well. Today, FOMC Member Bostic is going to speak about the interest rates and monetary policy which is expected to be quite neutral with the impact on USD gains in the coming days.

As of the current scenario, ahead of the upcoming high impact economic report of EUR of this week, certain volatility is expected in the market, whereas EUR might gain against USD for a certain period before the price continues with its bearish trend in future.

Now let us look at the technical view. The price is currently residing at the edge of the 1.1700-20 area from where it is expected to push higher towards the 1.1950-1.20 resistance area in the coming days. After such an impulsive bearish pressure, current bullish pressure is expected to be backed by the Bullish Continuous Divergence along the way. As the price remains above 1.1700 with a daily close, certain bullish intervention is expected in this pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română