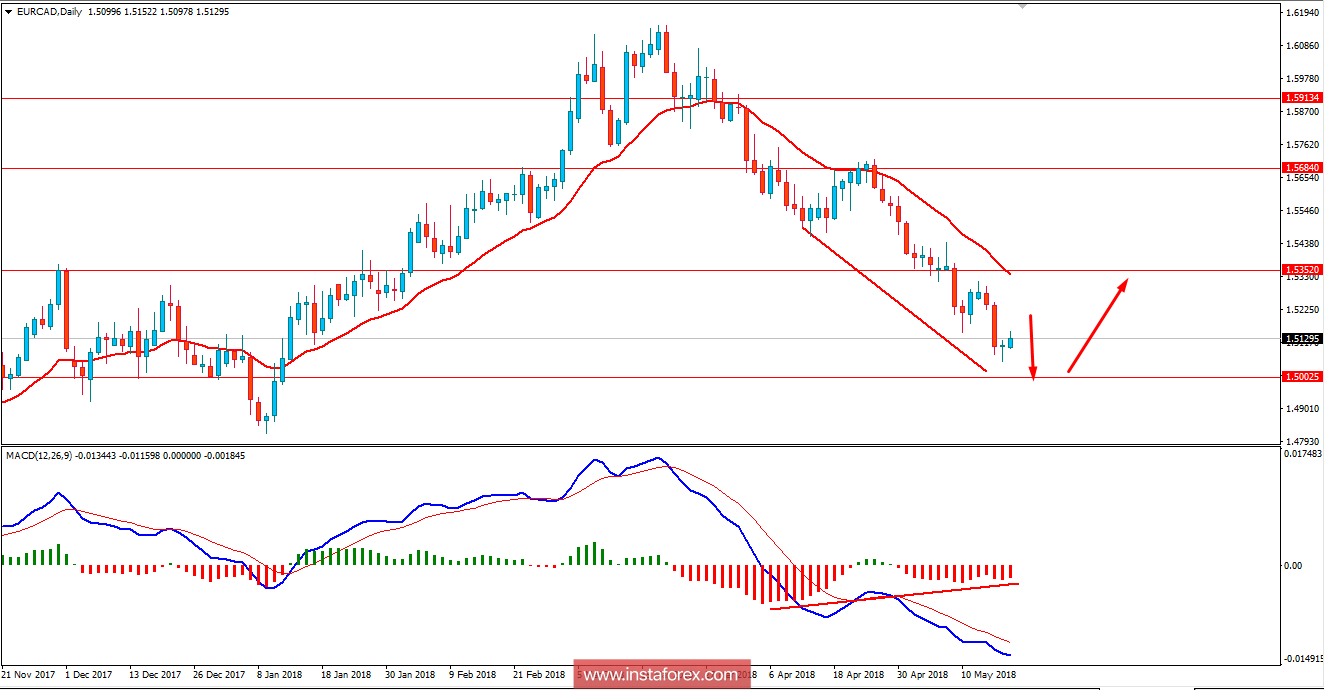

EUR/CAD has been non-volatile with the bearish gains since it broke and retested of 1.57 price area with a daily close. CAD has been the dominant currency in the pair for months now where EUR has failed to inject certain pullback along the process.

Today EUR German PPI report was published with an increase to 0.5% from the previous value of 0.1% which was expected to be at 0.3%, German WPI report also showed an increase to 0.5% from the previous value of 0.0% which was expected to be at 0.2% and Current Account report was published with decrease to 32.0B from the previous figure of 36.8B which was expected to be at 35.1B. Moreover, today EUR Trade Balance report is going to be published which is expected to decrease to 20.7B from the previous figure of 21.0B.

On the CAD side, today CPI report is going to be published which is expected to be unchanged at 0.3%, Core Retail Sales is expected to increase to 0.5% from the previous value of 0.0% and Retail Sales report is expected to decrease to 0.3% from the previous value of 0.4%.

As of the current scenario, CAD economic reports forecasts are quite optimistic currently which is expected to add to the gains of the CAD further in the coming days. Ahead of the upcoming ECB Monetary Policy Meeting next week, EUR is expected to gain certain momentum in the process which will lead to increased volatility and correction in the process. To sum up, CAD is expected to extend its gain further against EUR before the ECB meeting next week.

Now let us look at the technical view. The price has been quite indecisive with the daily close yesterday where the bullish momentum was not quite as expected. Ahead of the upcoming high impact CAD economic reports to be published today, the price is expected to push lower towards 1.50 area before showing any bullish pressure on the pair. The price has formed a Bullish Divergence along the way which is expected to be activated after 1.50 is retested and rejected with a daily close. As the price remains above 1.50 with a daily close, certain bullish intervention is expected in this pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română