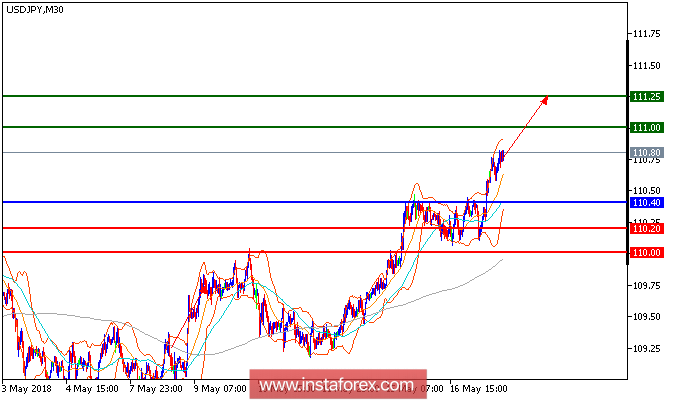

All our upside targets which we predicted in previous analysis have been hit. The pair is still trading in a higher range and expected to continue the upside movement. USD/JPY is proceeding toward the overhead resistance at 111.00 while being supported by the ascending 20-period moving average, which has just crossed above the 50-period one. The level of 110.40 has proven a strong downside support. The intraday configuration remains bullish, and the pair should target 111.25 upon reaching 111.25.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot point indicates a short position. The red lines show the support levels, and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, stop loss at 110.40, take profit at 111.00.

Resistance levels: 111, 111.25, and 111.50

Support levels: 110.20, 110.00, and 109.60.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română