GBP/USD has been struggling with indecision for last few days from where certain bullish momentum is expected to push the price higher for a certain period of time. Yesterday, impulsive bearish momentum in the pair has been observed due to worse outcome of the high impact economic reports of GBP published recently.

Recently, GBP Average Earning Index report was published with a decrease to 2.6% from the previous value of 2.8% which was expected to be at 2.7%, Claimant Count Change which is the GBP Unemployment Claims report was published with an increase to 31.2 from the previous from the previous figure of 15.7k which was expected to decrease to 13.3k and Unemployment Rate report was published with an unchanged value of 4.2%. Today, GBP CB Leading Index report is going to be published which is expected to be positive and better than the previous value of -0.4%.

On the USD side, today USD Building Permits report is going to be published which is expected to be unchanged at 1.35M, Housing Starts is also expected to be unchanged at 1.32M, Capacity Utilization Rate is expected to have a slight increase to 78.4% from the previous value of 78.0% and Crude Oil Inventories is expected to show less deficit at -1.1M from the previous figure of -2.2M. Additionally, FOMC Member Bostic is going to speak today about the upcoming interest rate decision and monetary policies which is expected to be quite neutral in nature.

As of the current scenario, certain volatility and corrective market momentum is expected in this pair as GBP has failed to provide better economic reports than expectation and USD upcoming high impact economic reports, forecasts are also quite dovish. Though there are certain chances of USD to gain some momentum with mixed economic reports results, but the gain against GBP at this certain period of time is expected to be quite temporary in nature as GBP is expected to inject some bullish pressure in the market in the coming days.

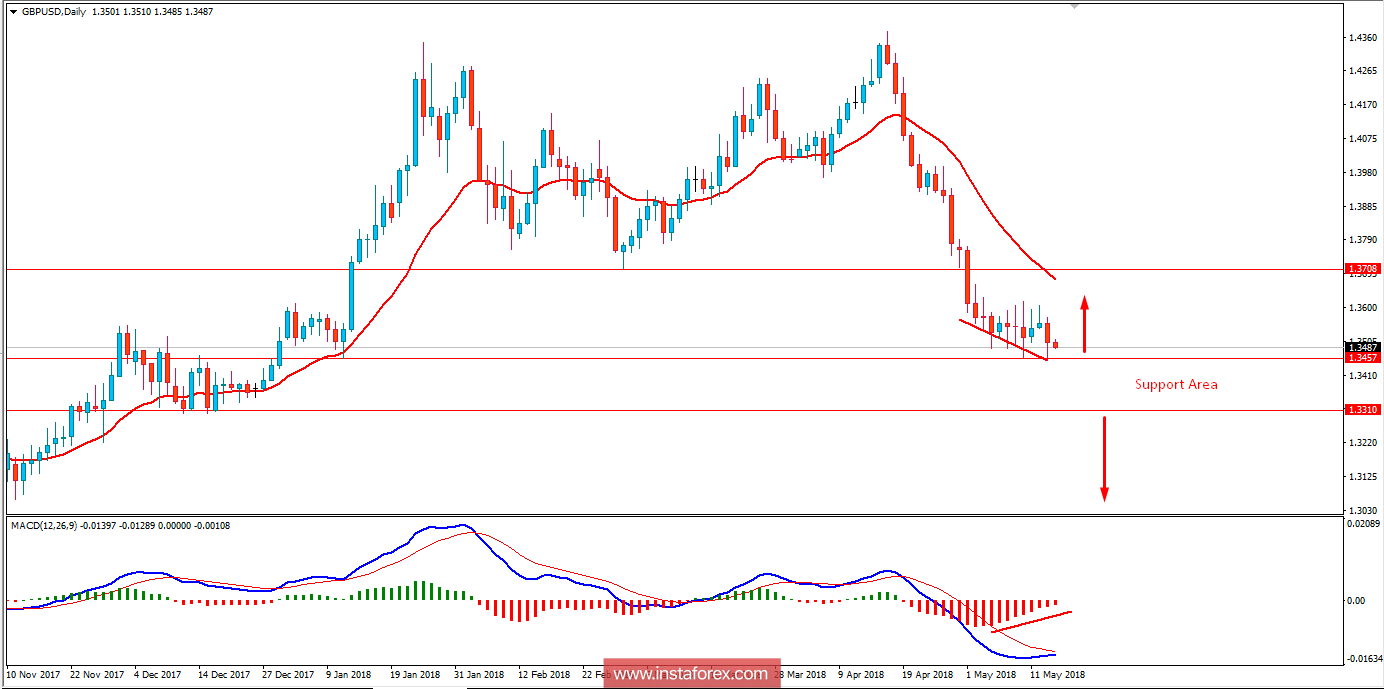

Now let us look at the technical view. The price has been correcting itself above the support area 1.33-1.3450 for last few days, from where it is expected to retrace higher towards 1.37 before showing any further bearish pressure in the coming days. Along the way during correction of last few days, Bullish Divergence has formed which is expected to increase the probability of the upcoming retracement in this pair. Though the bears are still quite strong in this pair right now, but the impulsive bearish pressure can only be seen after the price breaks below 1.33 with a daily close in the future. As the price remains above 1.37 with a daily close, further bearish pressure is expected in this pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română