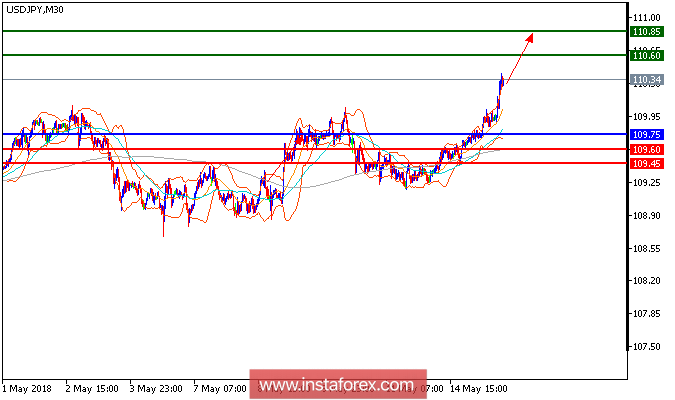

All our upside targets which we predicted in our previous analysis have been hit. The pair continued its rebound while being supported by the ascending 20-period moving average, which remains above the 50-period one. The relative strength index stayed elevated in the 60s, showing continued upward momentum for the pair. The bullish intraday outlook remains intact, and the pair should revisit 110.60 before targeting 110.85. On the downside, key support is located at 109.75.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot point indicates a short position. The red lines show the support levels, and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: Buy, stop loss at 109.75, take profit at 110.60.

Resistance levels: 110.60, 110.85, and 111.30

Support levels: 109.60, 109.45, and 109.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română