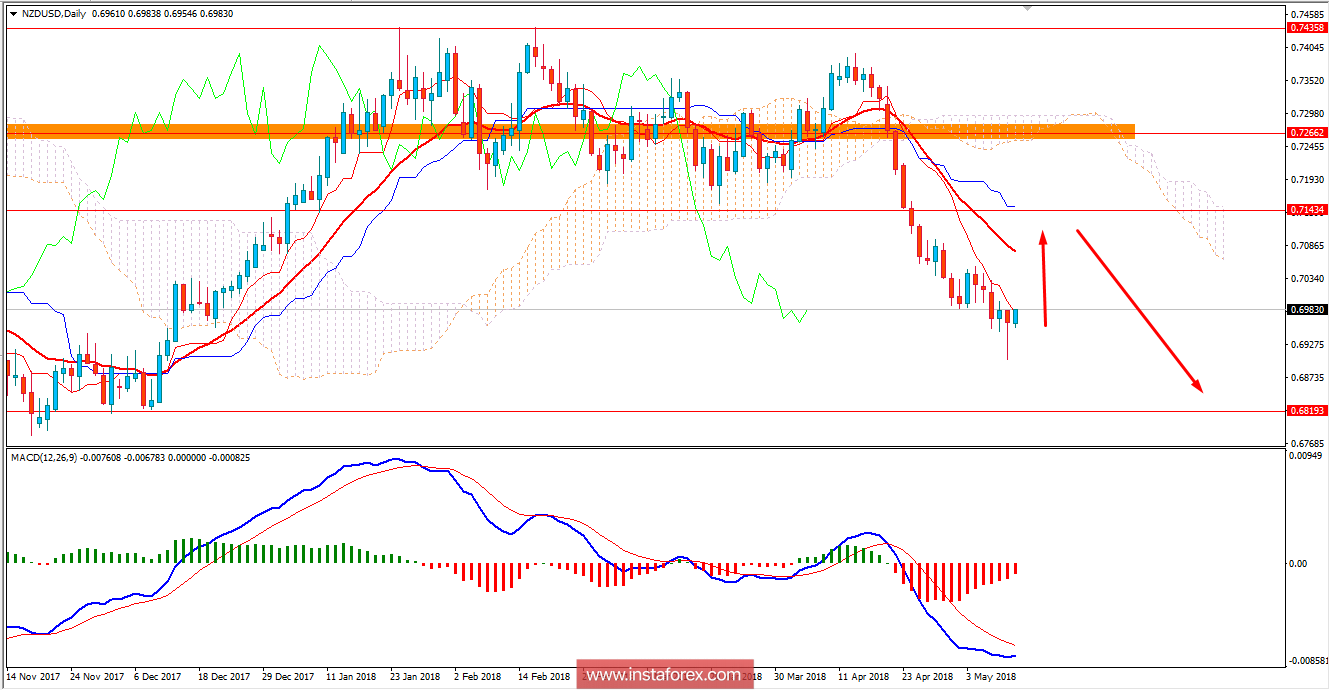

NZD/USD has been in non-volatile impulsive bearish pressure recently which was intervened with an impulsive bullish pressure yesterday, leading to certain bearish rejection in the daily candle. The recent weak USD economic reports lead to certain impulsive bullish pressure in the pair, whereas today's positive NZD economic reports helped the currency to extend the lead.

Today, NZD Business NZ Manufacturing Index report has been published with an increase to 58.9 from the previous figure of 53.1 and FPI report has been published with a decrease to 0.1% from the previous value of 1.0%. Though the results were mixed in nature, but a significant increase in Business NZ Manufacturing Index helped the currency to sustain the recent bullish momentum.

On the USD side, after the worse CPI economic reports published recently, today, Import Prices report is going to be published which is expected to increase to 0.5% from the previous value of 0.0%, Prelim UoM Consumer Sentiment report is expected to decrease to 98.4 from the previous figure of 98.8, and Prelim UoM Expectation is expected to increase from the previous value of 2.7%.

As of the current scenario, NZD is expected to gain some momentum over USD, following the recent positive economic reports which is expected to extend its gains in the coming days. Until USD fails to provide better economic report to continue its bearish momentum, NZD is expected to gain further momentum in future.

Now let us look at the technical view. The price has been quite impulsive with the break below 0.7150 which is currently expected to retest in the coming days, before continuing the bearish trend with target towards the 0.68 support area. The bearish bias is currently quite dominant, but as per yesterday's bearish rejection in the daily candle, certain bullish intervention is expected in this pair. As the price remains below 0.7150 with a daily close, the bearish bias is expected to continue in this pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română