USD/CHF has been non-volatile and quite impulsive with the bullish momentum since it bounced off the 0.9450 area. USD has been the dominant currency in the pair whereas CHF has been struggling with the recent economic reports and events where the outcome has been quite dovish recently.

This week CHF Foreign Currency Reserves report has been published where certain increase to 757B from the previous figure of 738B was witnessed and Unemployment Rate was also decreased to 2.7% from the previous value of 2.8% which was expected to increase to 2.9%, but it did not quite help the currency to impose some bearish pressure against USD in the process. Today, due to observance of holiday for Ascension day, there are no impactful economic report or event on the CHF side.

On the other hand, USD has been quite mixed with the recent economic reports, but that did not quite hamper the market sentiment pushing the price higher against CHF. Today, USD CPI report is going to be published which is expected to increase to 0.3% from the previous value of -0.1%, Core CPI is expected to be unchanged at 0.2%, Unemployment Claims is expected to increase to 219k from the previous figure of 211k, and Natural Gas Storage is expected to increase to 81B from the previous figure of 62B.

As of the current scenario, USD economic reports forecasts today are quite mixed which are expected to increase volatility in the market whereas CHF will have no or little impact on the upcoming gains. If the economic reports of USD to be published today are resulted better than expected, then further bullish momentum in this pair can be observed, which might lead to further dominant behavior of the USD against CHF in the coming days or else any negative results will lead to more volatility and may help CHF have the most required counter momentum to push the price lower.

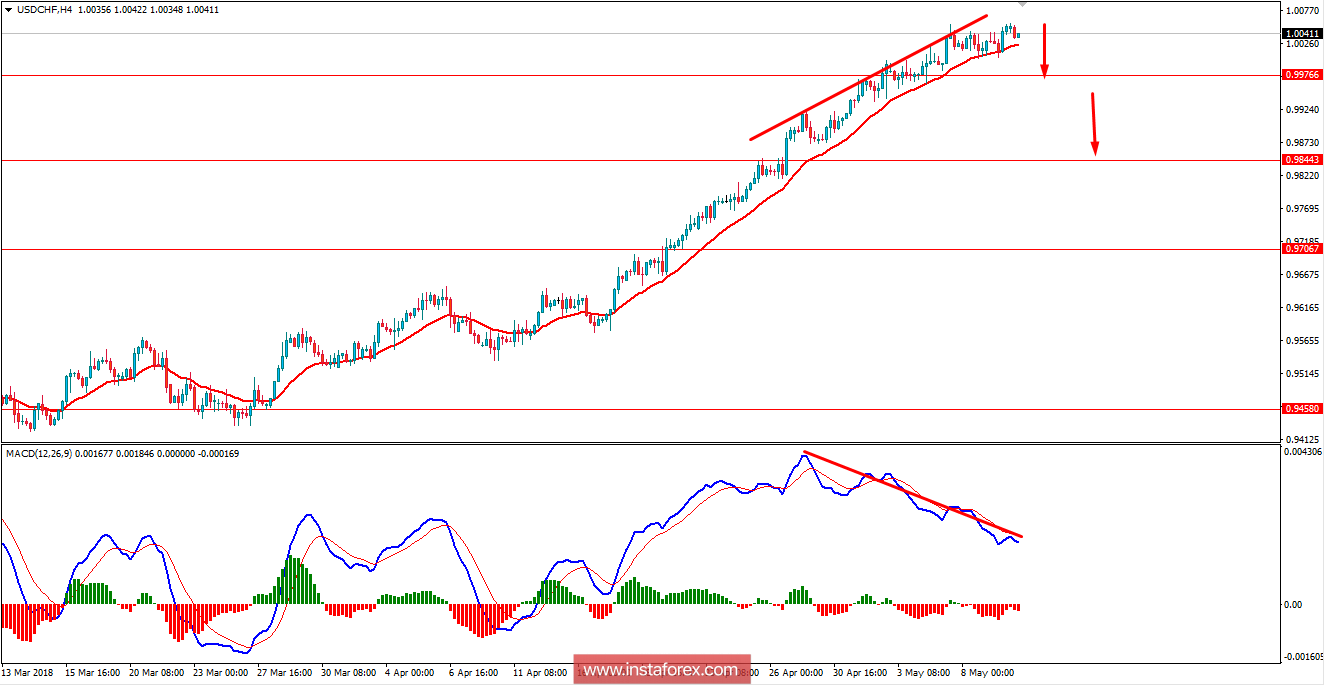

Now let us look at the technical view. The price has been non-volatile recently with no deeper pullback along the way to violate the dynamic level of 20 EMA along the way. The price has developed a Bearish Divergence in the H4 chart which is expected to push the price much lower towards the 0.9980-0.9850 support area in the coming days. Though the bullish trend is still quite strong and further bullish momentum can be way ahead, but certain volatility and counter momentum are expected in this pair for the coming before the price continues its bullish run again. As the price remains below the 1.0100 area, the bearish intervention is expected which might lead to short to medium-term bearish pressure in the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română