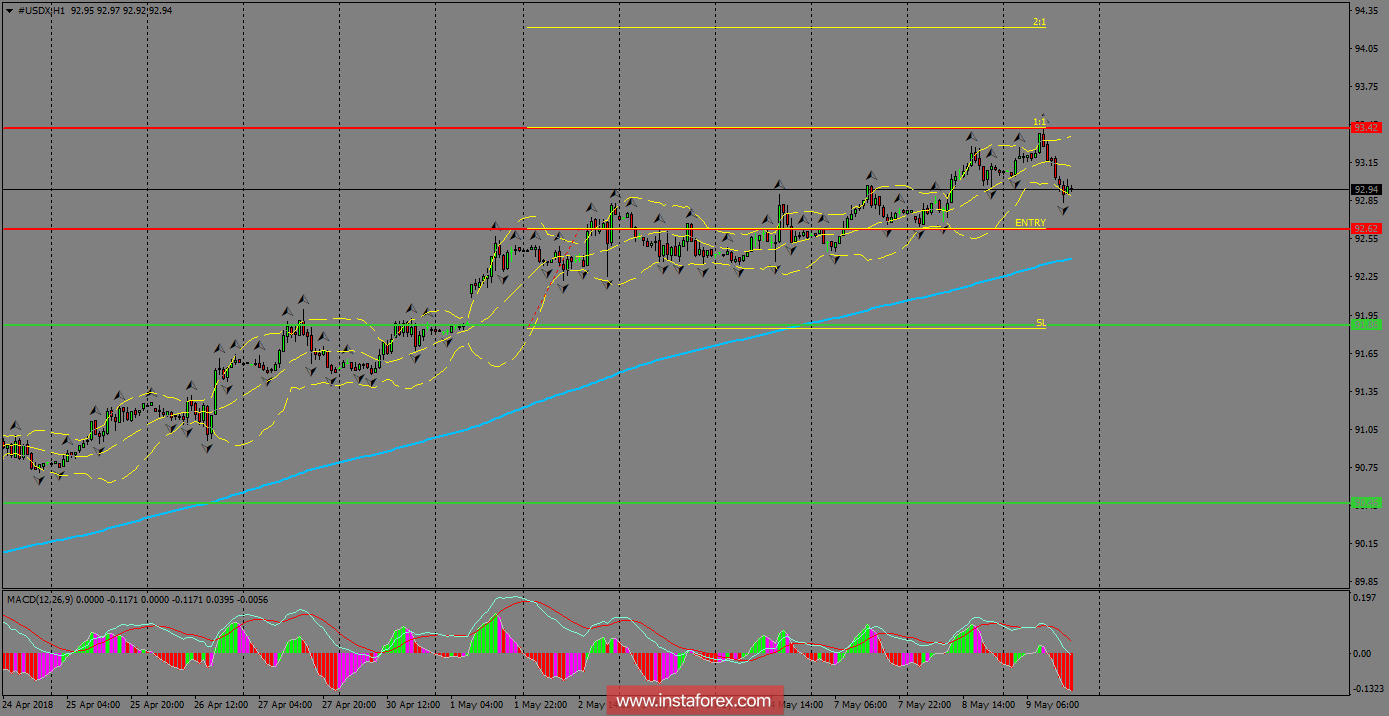

There is a volatile price action around the resistance zone of 93.42, where the bears are trying to gather momentum in order to take the index to test the 200 SMA at H1 chart. However, as long as it remains above the moving average, we're still expecting a rally to reach the 94.00 level. MACD indicator remains in the negative territory, favoring to the bears in the short-term.

H1 chart's resistance levels: 92.62 / 93.42

H1 chart's support levels: 91.86 / 90.46

Trading recommendations for today: Based on the H1 chart, place buy (long) orders only if the USD Index breaks with a bearish candlestick; the support level is at 9262, take profit is at 93.42 and stop loss is at 91.84. English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română