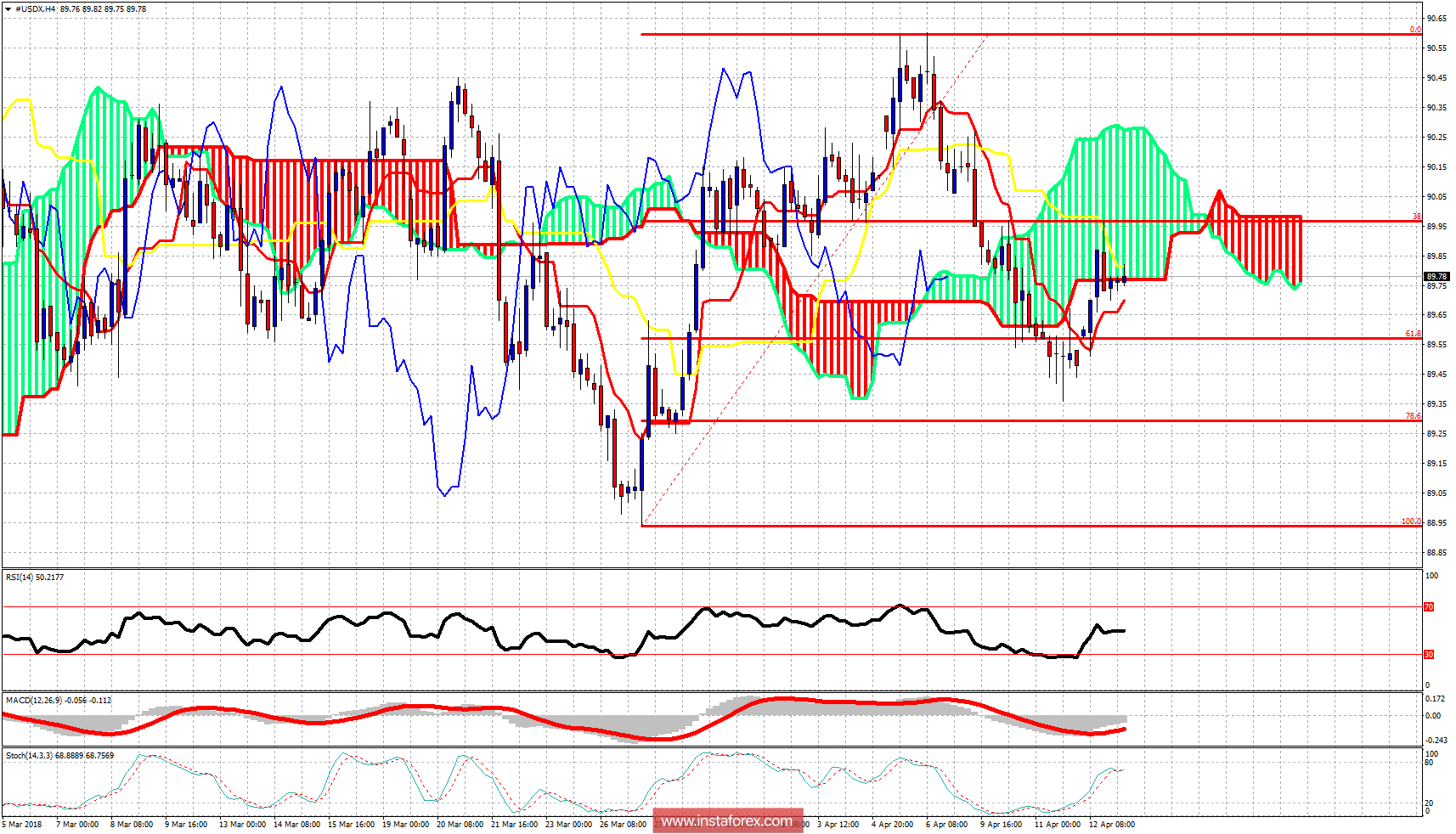

The Dollar index as expected bounced off the 61.8% Fibonacci retracement and reached the important resistance level of 90, but could not break above it and change the trend. The price got rejected and pushed back towards the lower cloud boundary. Bears remain in control of the trend as long as we are below 90.

The weekly candle is back above the weekly tankan-sen and so there are the hopes of bulls for a move towards 91.70. A weekly close above 89.60 is good for bulls. A weekly close above 90.30 would be an even better sign. Bears, on the other hand, need to see the price move below 89.35 and not above 90. What the price is going to do is very unclear for the short-term. Keep those price levels in mind for a clearer directional hint.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română