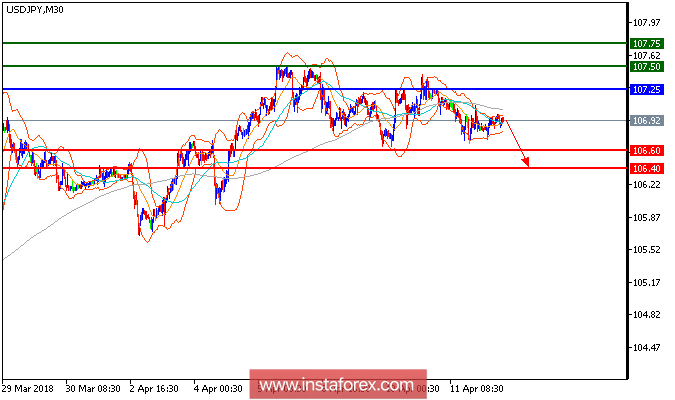

USD/JPY is under pressure and expected to trade with bearish outlook. The pair retreated from 107.05 (the previous high) and broke below its 20-period moving average after touching the 50-period moving average. The relative strength index is below its neutrality level at 50 and lacks upward momentum. Hence, as long as 107.25 is not surpassed, look for a return to 106.60 (lows of April 9 and 10). A break below of this level would trigger another decline to 106.40.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot point indicates a short position. The red lines show the support levels, and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: SELL, stop loss at 107.25, take profit at 106.60

Resistance levels: 107.50, 107.75, and 108.00. Support levels: 106.60, 106.40, and 106.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română