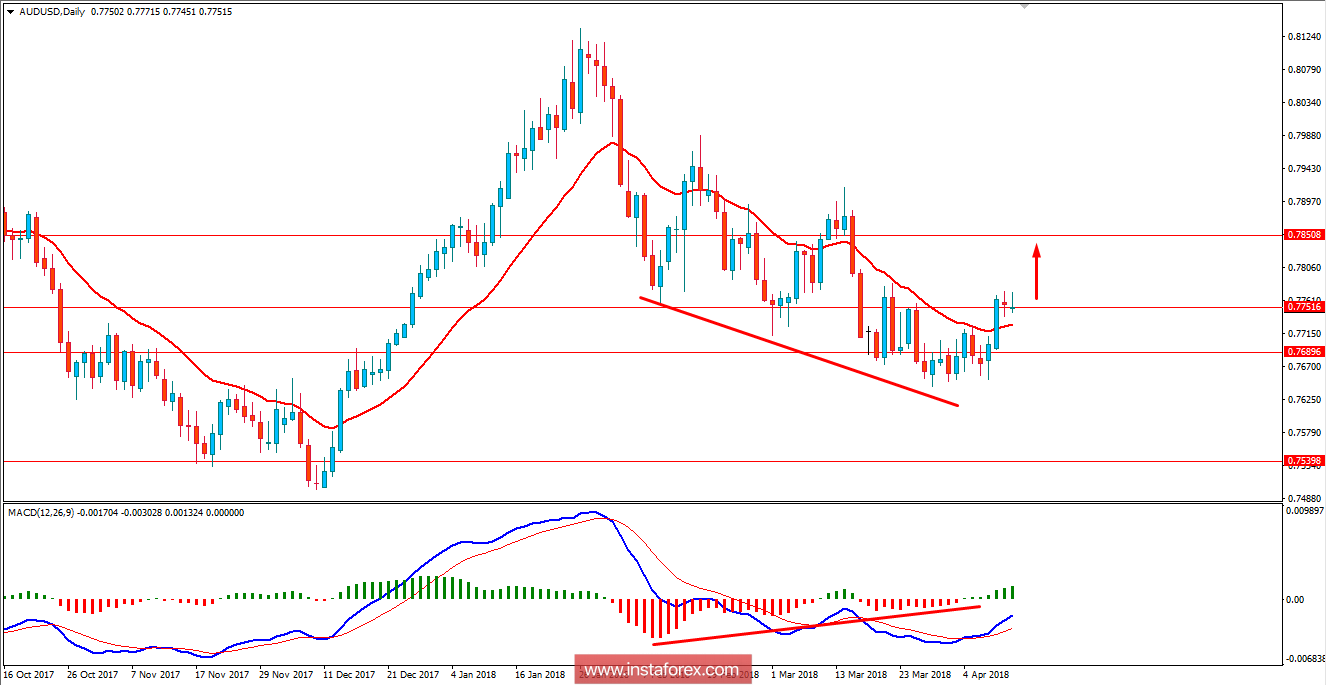

AUD/USD has been struggling below 0.7750 price area after an impulsive bearish pressure bouncing off the 0.81 area earlier. After the recent worse economic reports of USD got published, AUD gained good momentum which is turning quite unsustainable currently. Recently USD FOMC Meeting Minutes were held where the Budget Balance showed a certain decrease in deficit to -208.7B from the previous figure of -215.2B but failed to meet the expectation of -191.0B. Today USD Unemployment Claims report is going to be published which is expected to 231k from the previous figure of 242k, the Import Price is expected to decrease to 0.2% from the previous value of 0.4% and Natural Gas Storage is expected to decrease in deficit to -11B from the previous figure of -29B. On the AUD side, recently Governor Lowe spoke about the imbalance between the states of Australia whereas Queensland and Western Australia is leading on the growth in comparison to other states of the country, which lead the market sentiment to be indecisive and consolidating recently. Today AUD MI Inflation Expectation report was published with a decrease to 3.6% from the previous value of 3.7% and Home Loans showed an increase to -0.2% from the previous value of 1.0% which was expected to be at -0.3%. The economic reports on the AUD side were not quite remarkable to have an impulsive bearish pressure in the pair whereas USD also failed to provide proper information on the upcoming economic decisions in the FOMC Meeting. As of the current scenario, the pair is expected to continue its corrective phase for upcoming few days before certain impulsive breakout to be observed. To sum up, AUD is expected to have an upper hand over USD in the coming days until any positive high impact economic reports on the USD side help to regain its momentum.

Now let us look at the technical view. The price is currently residing at the edge of 0.7750 area from where is expected to proceed higher towards 0.7850 in the coming days. Though we can observe certain bullish rejection on the recent daily candles whereas Bullish Continuous Divergence is still in play and expected to help push higher in the future. As the price remains above 0.7550, the bullish bias is expected to continue further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română