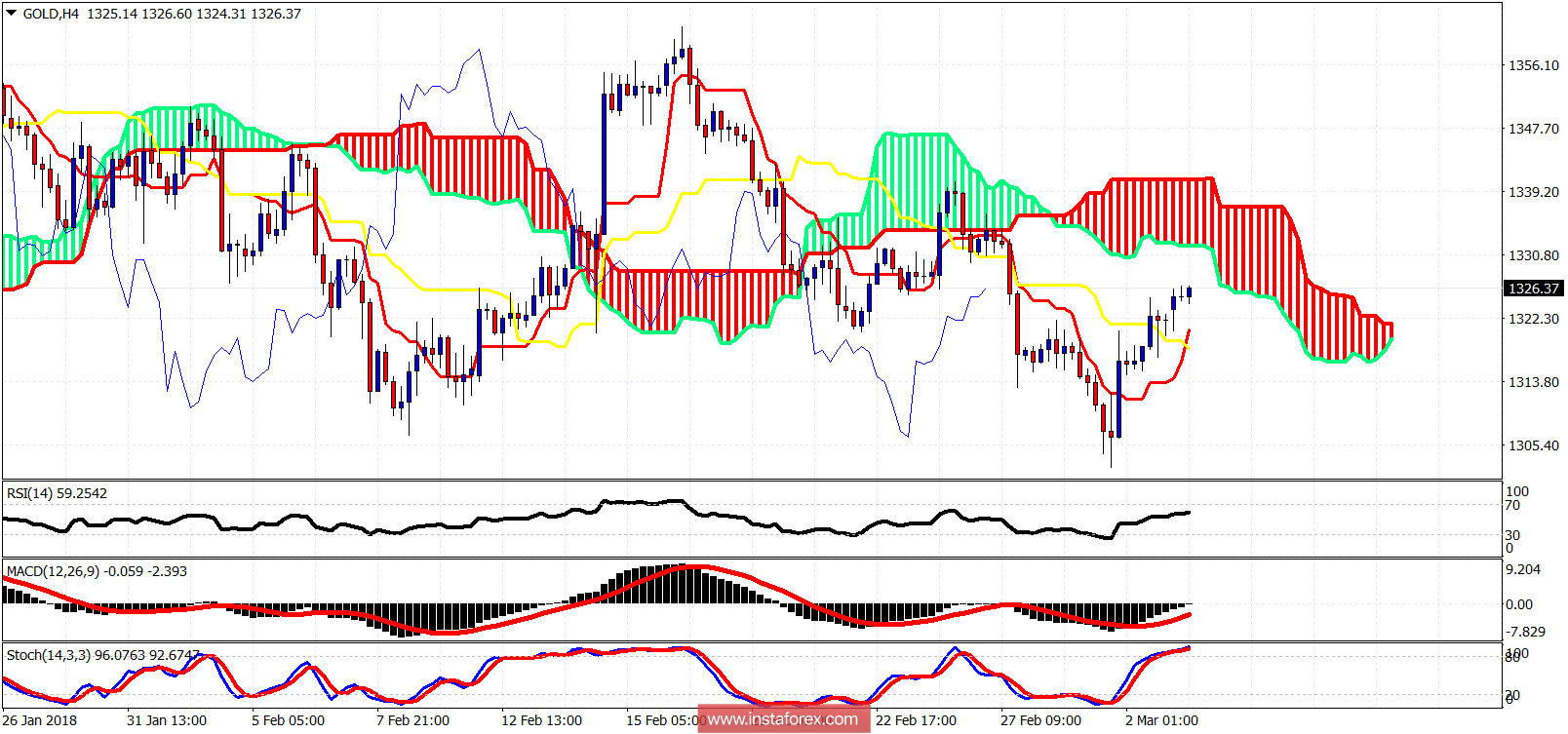

The Gold price is still trading below the Ichimoku cloud in the 4hour chart. The trend remains bearish. Important short-term resistance is just above $1,330. Bulls need to break it in order to continue to the bounce higher.

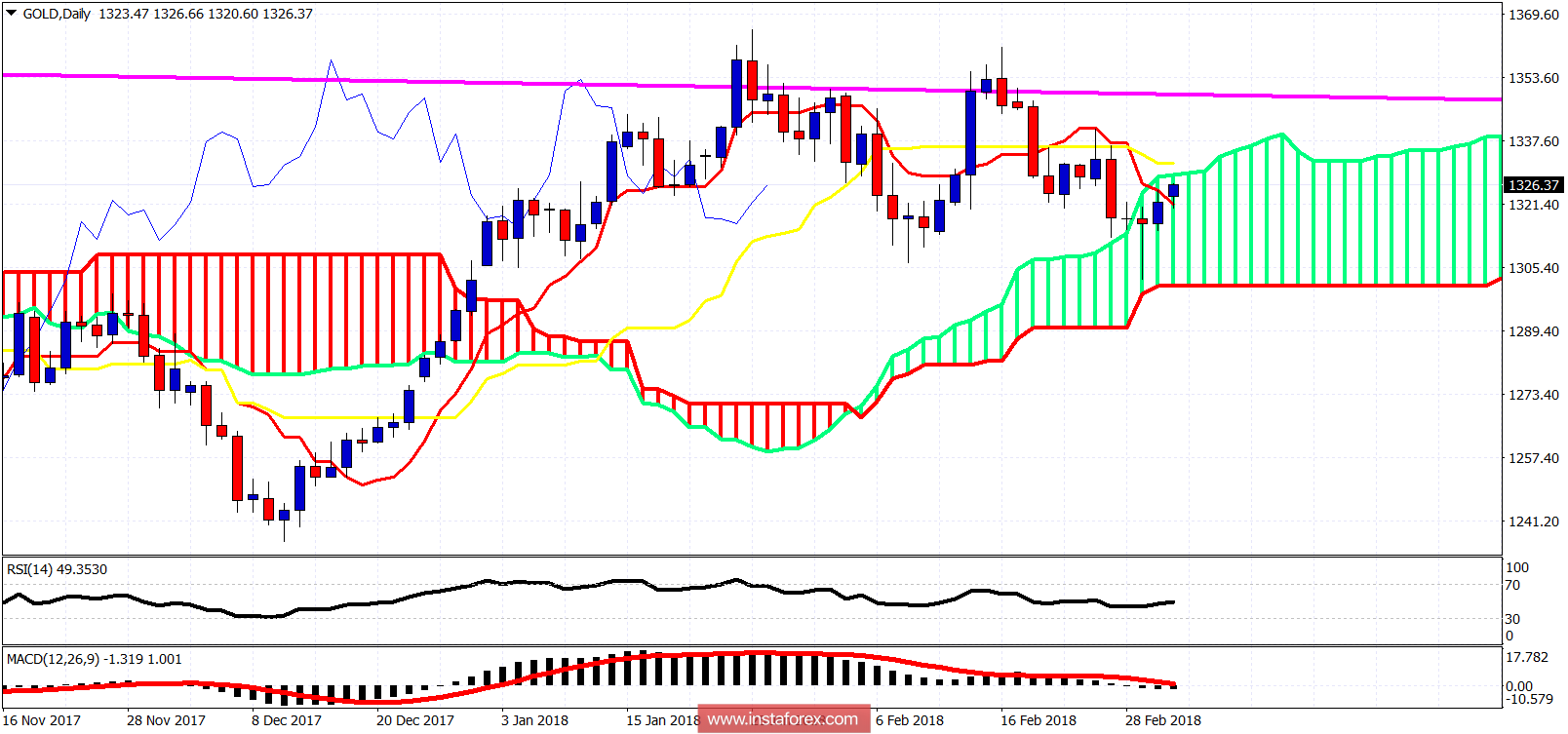

Magenta line - long-term resistance

The Gold price in the Daily chart remains inside the Kumo. The trend is neutral. Resistance is at the upper cloud boundary at $1,330-31. Support is at $1,300. As long as the price is above $1,300 and below $1,331 I prefer to be neutral or sell near resistance or buy near support. A break of either level will turn me bearish or bullish respectively.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română