Daily Outlook

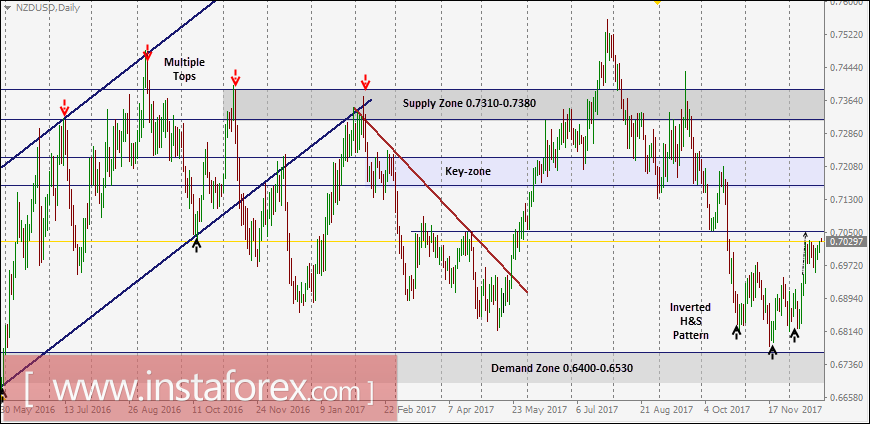

Bullish breakout above the downtrend line took place on May 22. Since then, the market has been bullish as depicted on the chart.

This resulted in a quick bullish advance towards next price zones around 0.7150-0.7230 (Key-Zone) and 0.7310-0.7380 which was temporarily breached to the upside.

Recent bearish pullback was executed towards the price zone of 0.7310-0.7380 (newly-established demand-zone) which failed to offer enough bullish support for the NZD/USD pair.

Re-consolidation below the price level of 0.7300 enhanced the bearish side of the market. This brought the NZD/USD pair again towards 0.7230-0.7150 (Key-Zone) which failed to pause the ongoing bearish momentum.

An atypical Head and Shoulders pattern was expressed on the depicted chart which initiated bearish reversal.

As expected, the price level of 0.7050 failed to offer enough bullish support for the NZD/USD pair. That's why, further bearish decline was expected towards 0.6800 (Reversal pattern bearish target).

Evident signs of bullish recovery was expressed around the recent low (0.6780). That's why, a bullish pullback is expected towards 0.7050.

Moreover, further bullish advance should be expected towards 0.7150 if enough bullish momentum is expressed above the price level of 0.7050.

Trade Recommendations:

An inverted Head and Shoulders pattern was established on the chart indicating high probability of bullish reversal.

That's why, the price zone of 0.6800-0.6830 was considered for a short-term BUY entry. Bullish persistence above 0.6950 (neckline) is mandatory to pursue towards next bullish targets.

S/L should be moved to 0.6900 to secure some profits. T/P level remains projected towards 0.7050 and 0.7150.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română