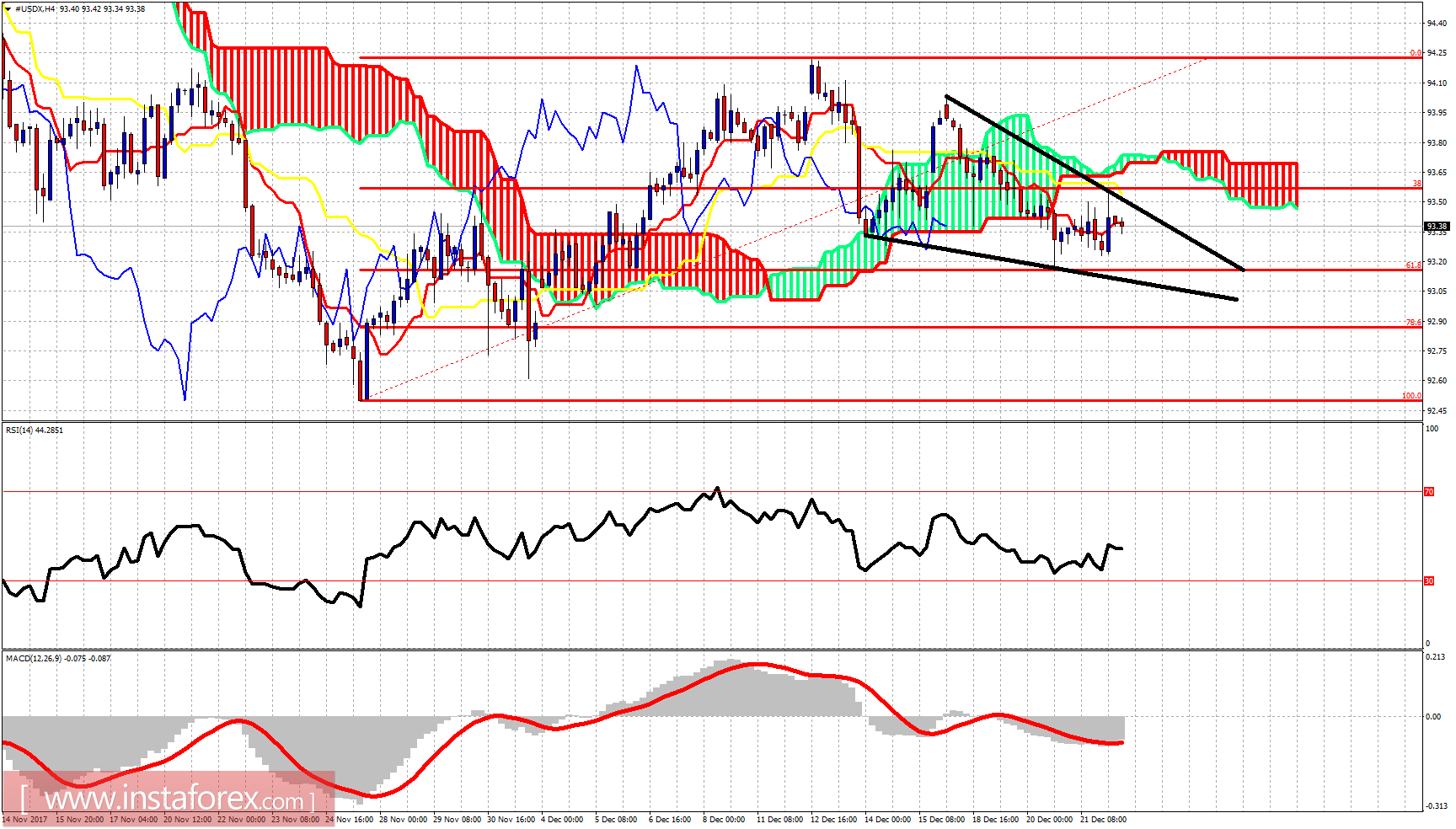

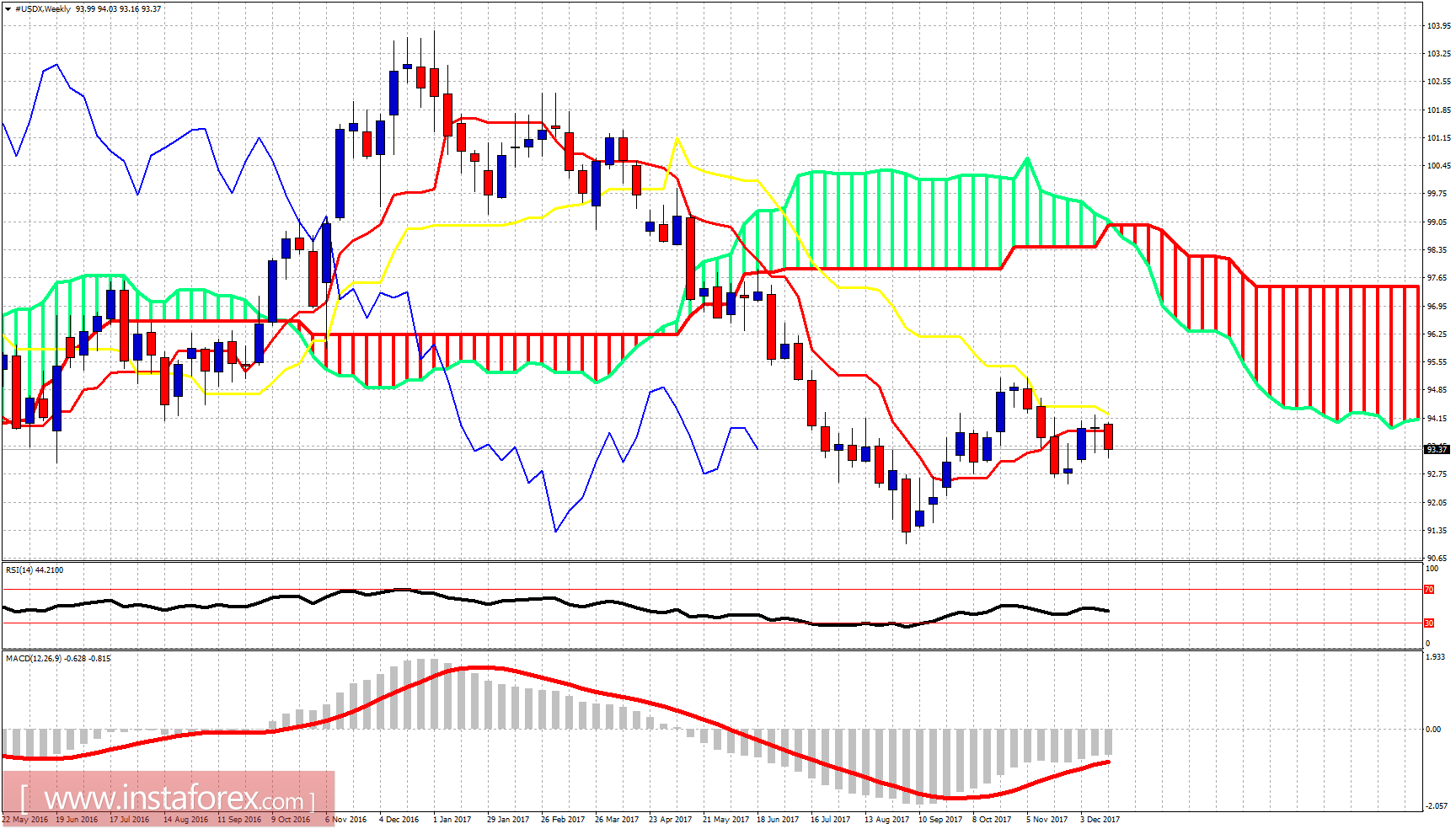

The Dollar index tried to bounce and resume the up trend yesterday but got rejected at the cloud resistance and remains inside a downward sloping triangle, what is most probably a bullish wedge pattern.

Trend remains bearish as price is making lower lows and lower highs. Price bounced yesterday towards cloud resistance but got rejected. Price remains below the 4-hour cloud and this is not good for bulls. Support is at 93.15-93. Resistance is at 93.50-93.60. Important resistance that will change trend to bullish is at 93.80.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română