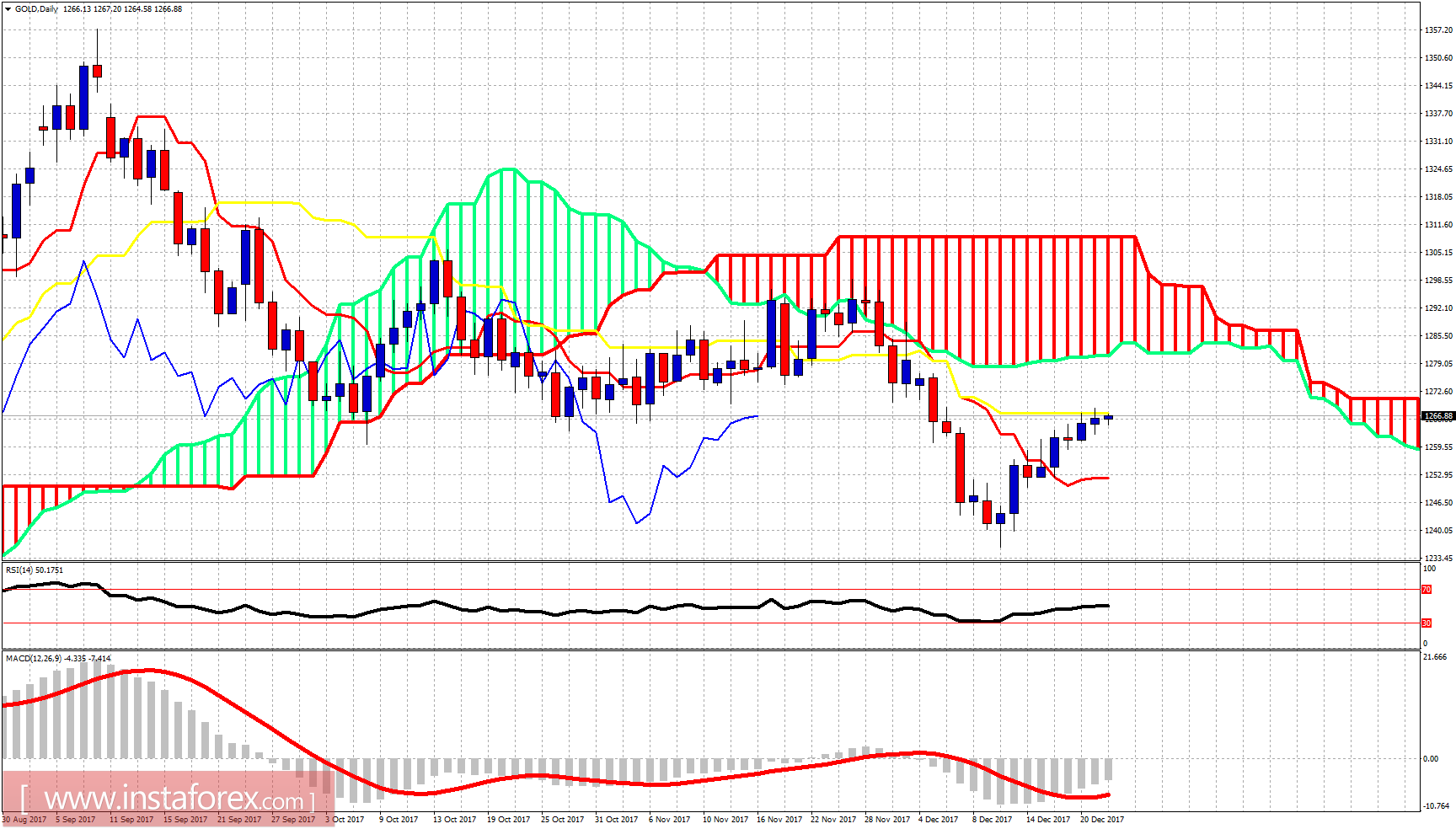

Gold price remains near the important $1,266-70 resistance area. Trend remains bullish but price has made no real progress over last few days. Gold price is expected to reverse and at least test support at $1,250. I'm bearish, expecting a move even towards $1,220.

Gold price is not moving higher in an impulsive pattern. Price although trading above the 4-hour Kumo (cloud) has formed a bearish wedge. Support is at $1,263 and at $1,260. Breaking below these levels will give me a new sell signal with $1,250 as minimum target. Price is right below the 61.8% Fibonacci retracement of the latest downward move and I'm bearish here.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română