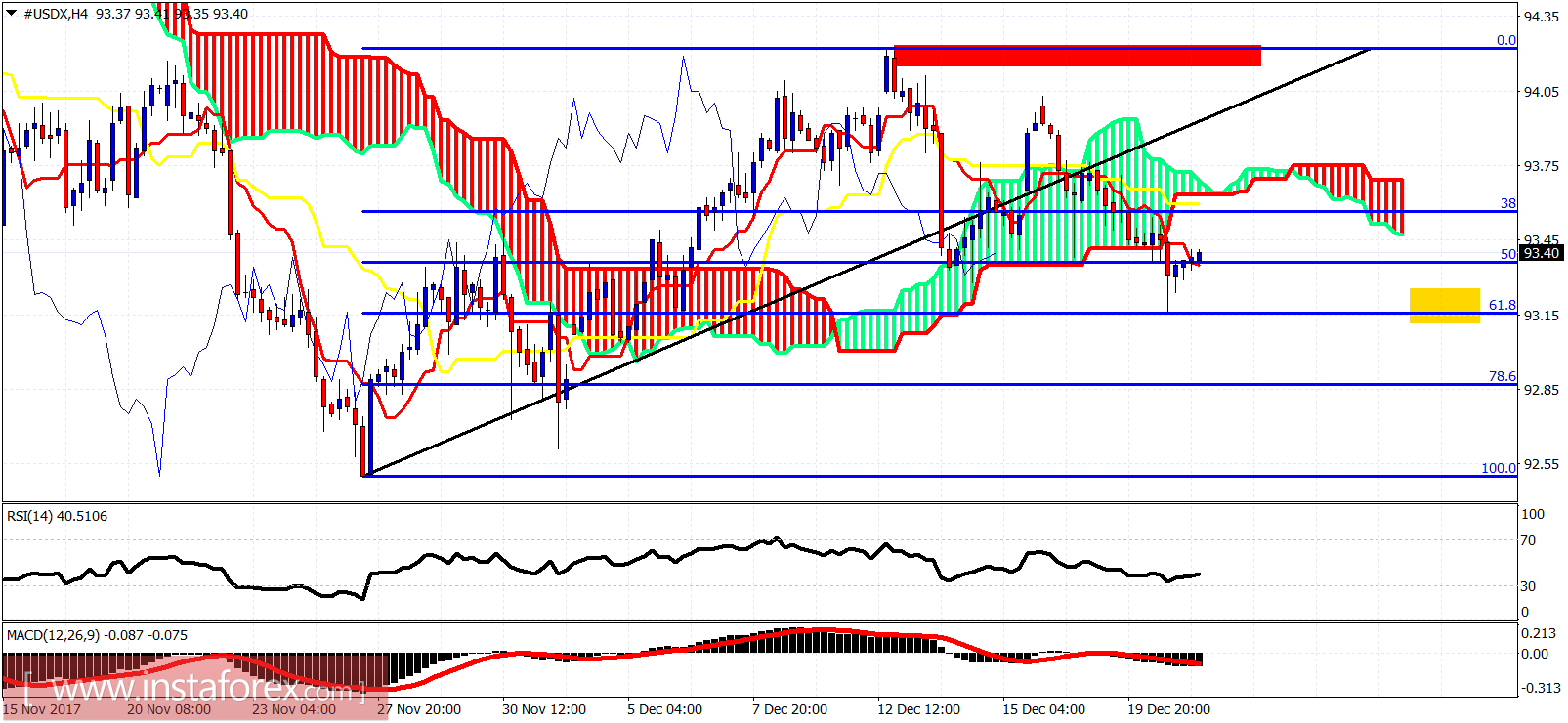

The Dollar index has broken through cloud support and short-term trend has changed to bearish. However price shows reversal signs off the 61.8% Fibonacci retracement. Last line of defense for bulls now is the 92.50 level. However bears have the upper hand as long as price is below 94-94.30.

The Dollar index is making lower lows and lower highs in the 4-hour chart. Price is below the cloud. Trend is bearish. Support is at 93.15 and resistance at 93.65.

On a weekly basis, the weekly candle shows a rejection at the kijun- and tenkan-sen indicators. This is a bearish sign. However I expect the Dollar to strengthen today and tomorrow so we have to be patient to see how the weekly candle closes. A weekly close above 93.60 this week will be a positive sign for next week. I'm bullish the Dollar index.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română