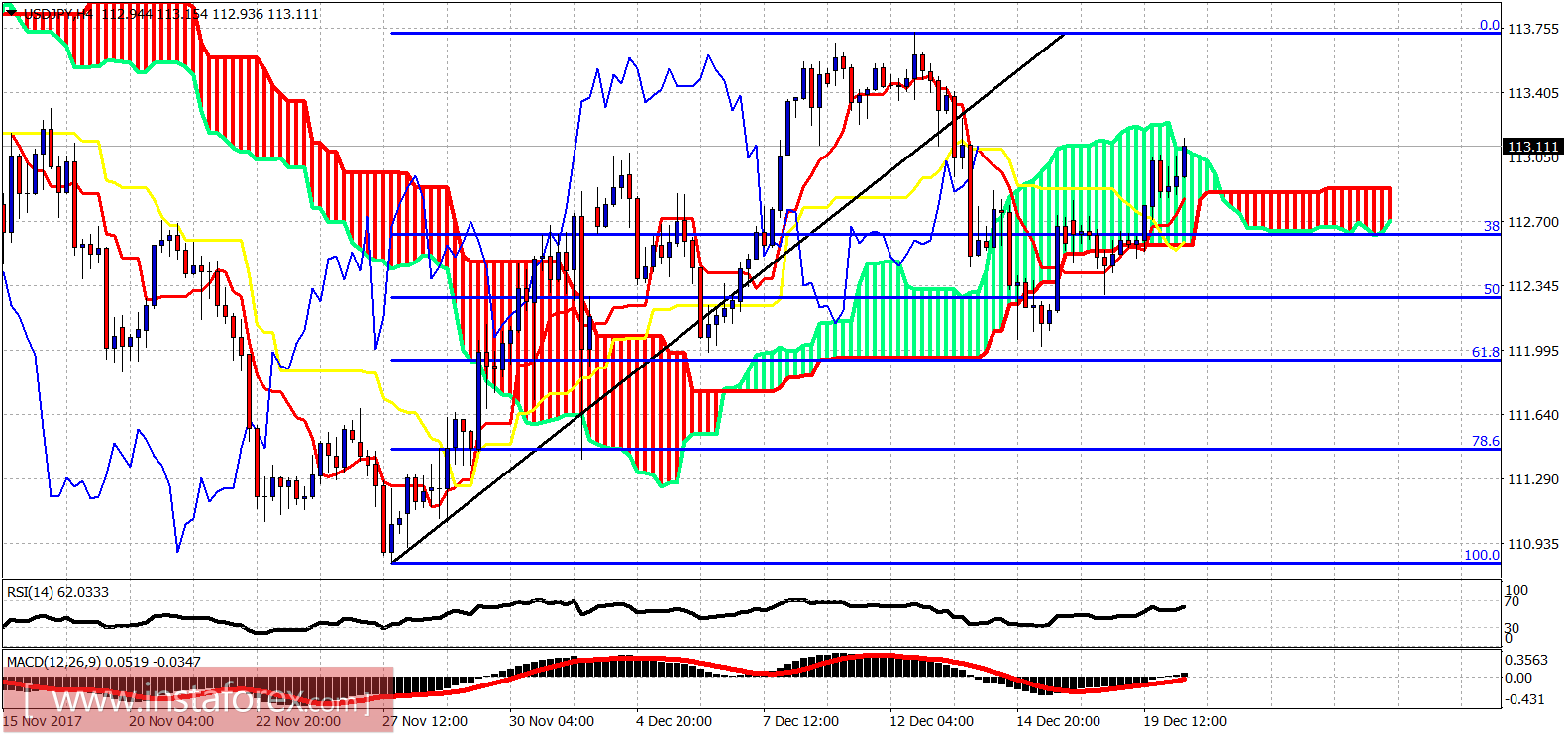

The USD/JPY pair is in a bullish trend. A short-term pullback has most probably finished at 112 and I'm now expecting a move towards 114.50-115. Confirmation for this will come with the daily close above 113.50.

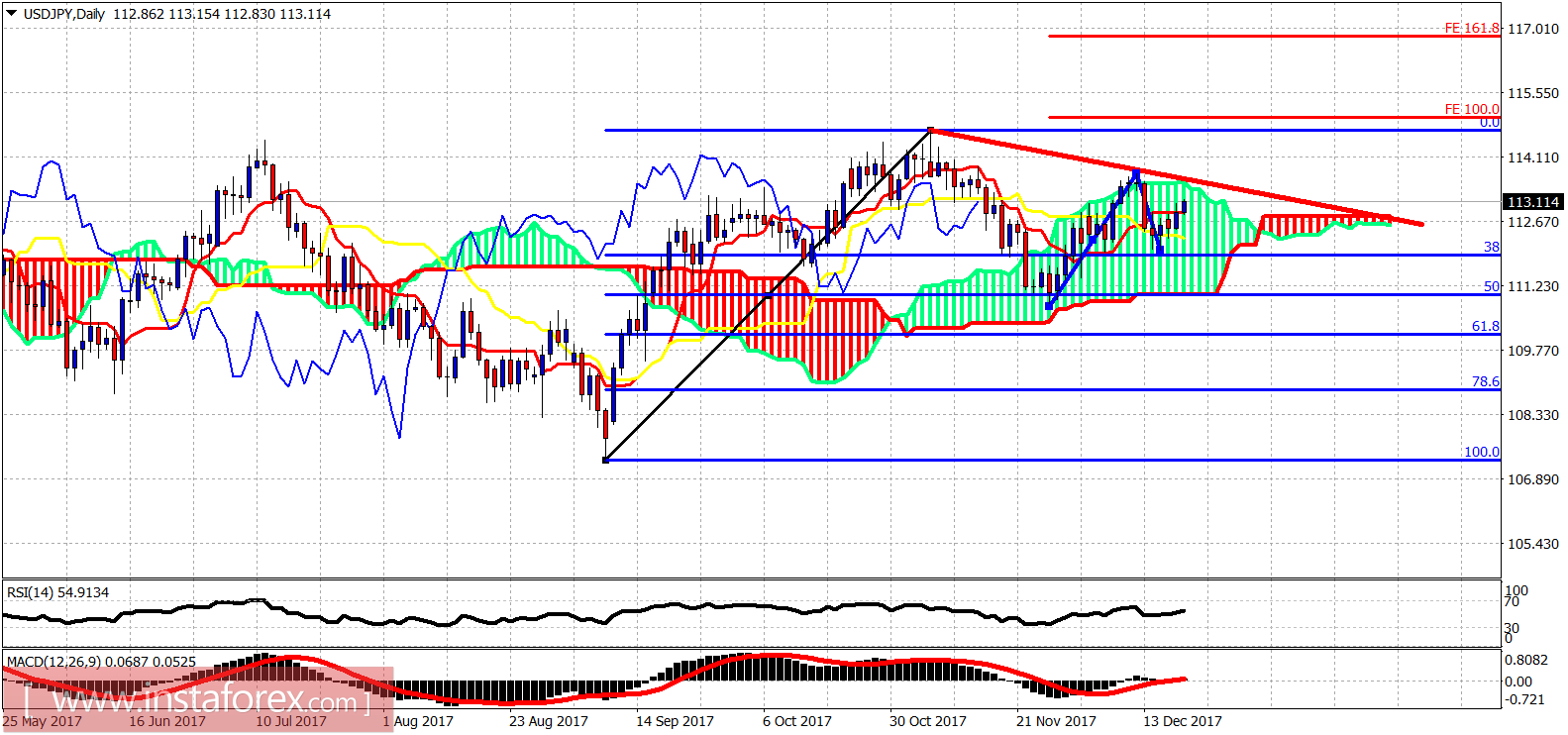

The USD/JPY pair is inside the Daily Kumo (cloud). Trend is neutral in the daily chart. The resistance trend line is at 113.20-113.30. If we close above it, I expect the equal extension of the first rise to push this second bullish wave towards 115. An extended rise will push price towards 117. Cloud resistance is the same in the daily chart with the trend line resistance. This increases the importance of the resistance level of 113.20-133.30.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română