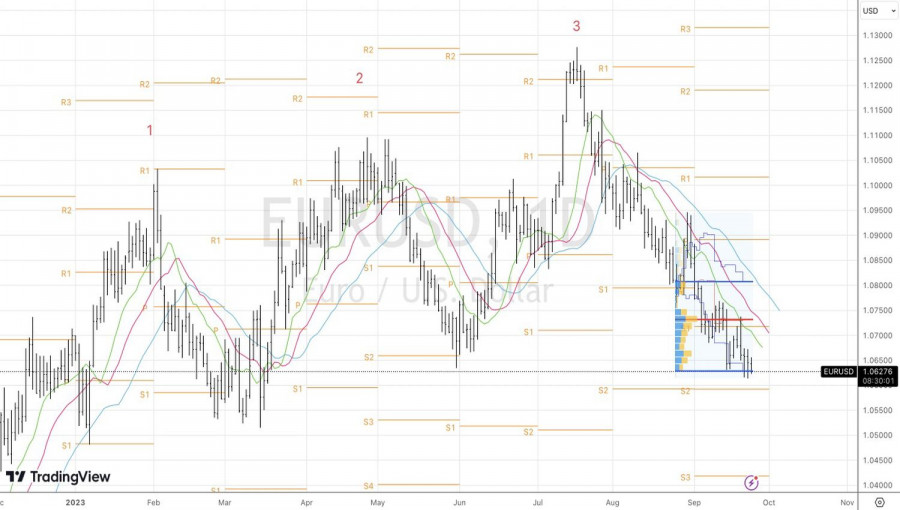

While Europe grapples with sticky inflation and economic growth anemia, the United States is enjoying GDP expansion above the trend. This period of American exceptionalism is bolstering the dollar and has led to EUR/USD marking a 10-week losing streak, the longest in the history of the euro. The threat of a recession in the eurozone is compelling traders to bet on a loosening of the ECB's monetary policy in July 2024. Meanwhile, hedge funds have raised their bearish bets on the regional currency to nearly a yearly high.

Dynamics of EUR/USD and speculative positions on the euro

It may seem that after such an extended losing streak for EUR/USD, a correction is in order. Nothing in the market lasts forever. No matter how strong a trend is, there are occasional pullbacks. However, perhaps the time has not yet come.

A substantial budget deficit and the strength of the U.S. economy are driving the sale of Treasury bonds. As a result, their yields and attractiveness are rising, leading to capital flowing into the United States and strengthening the U.S. dollar. The rally in oil is adding fuel to the fire, intensifying fears of a return to high inflation and the resumption of the Federal Reserve's monetary tightening cycle. As a result, the yield on 10-year U.S. Treasury bonds has once again exceeded 4.5%, the highest since 2007.

According to Bank of America, the yields on 10-year bonds will reach 4.75%. In this scenario, RBC Capital Markets' forecast of the euro falling to $1.02 no longer seems overly bearish. Similarly, the idea from Capital Economics about the main currency pair returning to parity doesn't seem far-fetched.

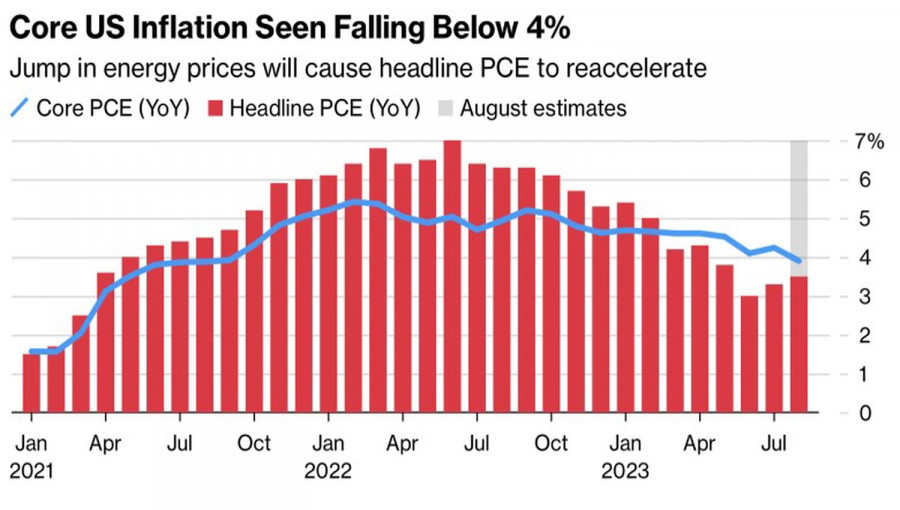

The main events of the last week of September are the releases of data on U.S. and European inflation. According to Bloomberg experts' forecasts, the core personal consumption expenditures (PCE) price index in the U.S. may slow to less than 4% for the first time in two years. Its Eurozone counterpart risks dropping to 4.8%, the lowest level in 12 months.

Dynamics of inflation in the USA

In theory, a slowdown in inflation at the end of a monetary tightening cycle is considered a bearish factor for a currency. In such a scenario, the likelihood of further interest rate hikes diminishes. On the other hand, everyone knows the Federal Reserve's desire not to repeat past mistakes. In the 1970s, the central bank prematurely believed it had won the battle against inflation and was punished with a double recession.

In light of this, it's not surprising to hear hawkish speeches from FOMC officials. For example, Michelle Bowman asserts that the Federal Reserve will need to raise borrowing costs again to combat persistently high prices. Her colleague, Boston Fed President Susan Collins, believes it's too early to conclude that inflation is clearly on a downward trend and will return to the 2% target.

Technically, EUR/USD's inability to stay within the fair value range of 1.0625–1.081 is opening the door for the currency pair to head downward towards 1.059 and 1.051. We continue to adhere to a selling strategy.