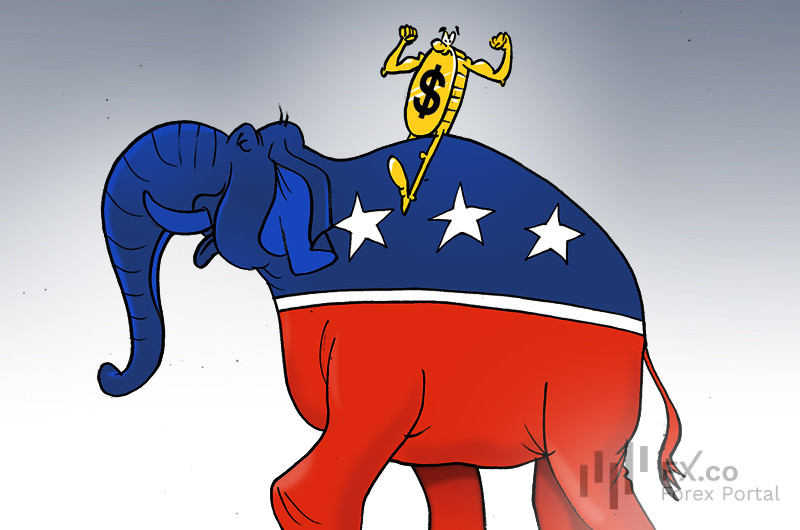

Goldman Sachs predicts that the euro could lose as much as 10% of its value if Donald Trump returns to power and resumes his favorite pastime—imposing tariffs. Strategists at the bank, who are closely monitoring global currency markets, warn that a Republican victory could trigger an increase in tariffs and a decrease in taxes in the United States, leading to a surge in the dollar and a collapse in the euro.

If the government is split, experts anticipate a modest rally for the greenback, lacking significant momentum. Conversely, if the Democrats take the throne, the dollar is likely to lose some ground, with markets reassessing the likelihood of dramatic changes in tariff policy.

Currencies closely tied to US trade policy, especially those linked to China, such as the Mexican peso, Chinese yuan, and South Korean won, are particularly vulnerable to these shifts. The euro and Australian dollar will likely follow suit, as both await a chance to recover from recent market turbulence.

According to Goldman Sachs, if Republicans aggressively target China and tariffs, the yuan could fall to 7.40, while the euro could lose about 3% of its value. In the event of broad-based global tariffs, the euro could potentially drop by as much as 10%, thus highlighting the far-reaching impact of US trade policy.

Meanwhile, the Japanese yen remains a dark horse. With numerous competing factors at play, even experienced Goldman Sachs strategists are hesitant to make bold predictions.

Goldman Sachs also reminds investors that US policy is just one of many factors that influence currency markets. Experts recommend caution and limited reliance on historical data. After all, the events of 2018-2019 have shown that developments can unfold in the most unexpected ways.

Deutsch

Deutsch

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: