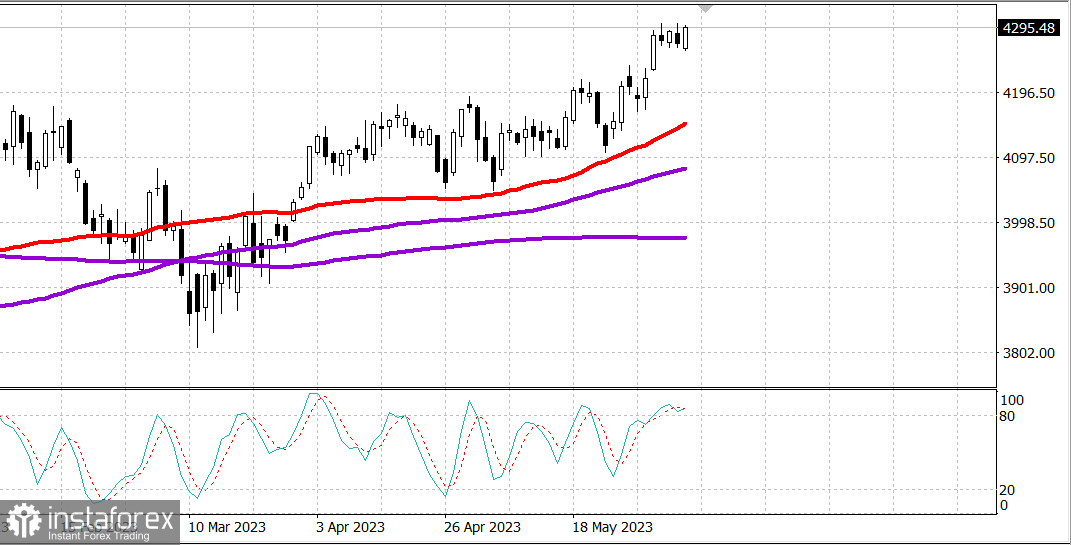

S&P500

06/09 Review

US Market: Growth.

The main US indices rose on Thursday: Dow +0.5%, NASDAQ +0.9%, S&P500 +0.6%, S&P500 4295, range 4250-4330.

It was a good day for the stock market. In accordance with the tradition of 2023, mega-cap stocks were the driving force at the beginning, while the broader market showed some weakness. However, by the close, more stocks participated in the upward movement.

Nevertheless, growth in the mega-cap space on Thursday was an integral part of the index dynamics. Apple (AAPL 180.57, +2.75, +1.6%), Amazon.com (124.25 AMZN, +3.02, +2.5%), which was rated Overweight by Wells Fargo, NVIDIA (NVDA 385.10, +10.35, +2.8%) and Tesla (TSLA 234.86, +10.29, +4.6%), which recorded their tenth consecutive rise, were among the largest support factors. The Vanguard Mega Cap Growth ETF (MGK) rose 1.0%.

ETF Invesco S&P 500 Equal Weight (RSP) fell by 0.6% and closed unchanged, while the market-cap weighted S&P 500, which struggled with the 4300 level again today, rose by 0.6% and closed near its daily highs.

The market breadth was somewhat negative for most of the session, but the advances and declines on the NYSE and Nasdaq were almost equal in number of stocks.

Most sectors of the S&P 500 closed higher, while real estate (-0.7%) and energy (-0.5%) fell. The energy sector partly responded to the drop in oil prices ($71.24 per barrel, -1.24, -1.7%) amid reports that the US and Iran are nearing a new deal on oil processing and exports. However, the White House denied these reports.

消费品行业(+1.6%)成为11个行业中的领头羊,其中Amazon.com和特斯拉起到了推动作用。与此同时,Wynn Resorts(WYNN 103.06,-0.20,-0.2%)和Las Vegas Sands(LVS 57.82,-0.67,-1.2%)在Jefferies将评级从“买入”下调至“持有”后成为最差的组成部分之一。

其他最成功的行业包括信息技术(+1.1%)和消费品行业(+0.8%)。信息技术行业得到了苹果和微软(MSFT 325.26,+1.88,+0.6%)的支持,以及半导体组件相对强劲的表现。PHLX半导体指数上涨了1.1%。

值得注意的是,罗素2000指数(-0.4%)昨天落后了,在本周之前一直是领头羊,但在下跌1.1%后反弹。考虑到今天的损失,这仍然是本周表现最好的指数,上涨了2.7%。

市场参与者也对每周失业救济申请初步报告做出了反应,该报告达到了自2021年11月以来的最高水平(261,000),这刺激了国债市场的购买兴趣。

2年期债券收益率下降3个基点至4.52%,而10年期国债收益率下降7个基点至3.71%。下降的市场利率为大型市值公司和其他成长股提供了额外支持。

- Nasdaq Composite:年初至今上涨26.5%

- S&P 500:年初至今上涨11.8%

- 罗素2000:年初至今上涨6.8%

- S&P Midcap 400:年初至今上涨5.2%

- 道琼斯工业平均指数:年初至今上涨2.1%

经济数据概述:

- 截至6月3日结束的一周内,失业救济初始申请增加了28,000,达到261,000(共识为237,000),而截至5月27日结束的一周内,继续领取失业救济的申请人数减少了37,000,降至1,757,000。初始申请是一个领先指标,自2021年11月以来达到了最高水平。

- 报告的关键结论是初始申请的激增,因为它意味着劳动力市场的某种缓解,这是美联储希望看到的,尽管申请水平仍远低于过去的经济衰退水平(即高于375,000),市场参与者应该相对满意。

- 4月份的批发库存下降了0.1%(共识为-0.2%),而前一个读数为下降0.2%(从0.0%修订)。

- 美国能源信息署每周天然气库存增加了104亿立方英尺,而上周增加了96亿立方英尺。

星期五美国没有重要的经济数据。

能源: 布伦特原油价格为75.30美元。

特斯拉计划在西班牙投资45亿欧元建厂。

结论。 美国市场处于年内最高点。预计将继续上涨,但只在强劲回调时购买。

Mikhail Makarov,更多分析:

中文

中文

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română