According to some experts, oil prices are affected not only by global production, but geopolitical risks as well. Supply disruptions weigh on oil prices too. Iran, Iraq, Libya, Nigeria and Venezuela, the 'Fragile Five' petrostates, continue to have supply disruption potential, posing a threat to the global oil market. Check out the influence of these nations on the process of the global oil output.

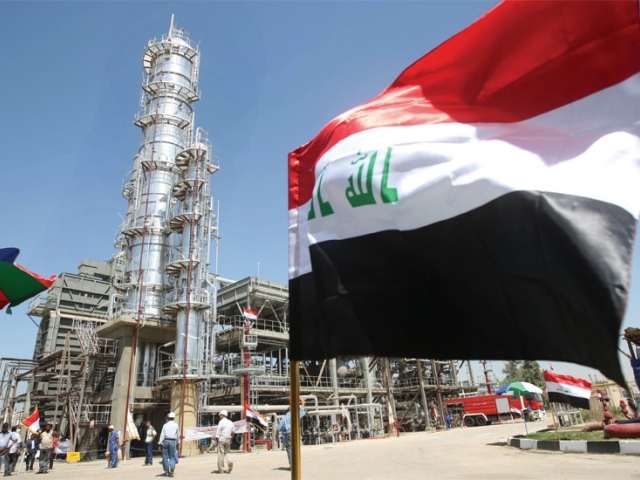

Iraq

Analysts say that the biggest risk comes from Iraq. Geopolitical tensions are rising in the country. The most recent incident includes the unexpected seizure of Kirkuk's oil fields by the Iraqi government, which disrupted some oil shipments. As a result, shipments at the Turkish port of Ceyhan, the destination for Iraq's oil exports, fell to 196,000 bpd. Economists estimate potential outage at 600,000 bpd.

Iran

The geopolitical behavior of Iran is also creating an unpredictable oil market. The major danger to Iran is a return of US sanctions, which could scare off investors and sharply reduce Iranian oil exports. According to Goldman Sachs, a few hundred thousand barrels of oil exports could be at risk. However, that is the worst-case scenario.

Libya

This OPEC member was exempted from the OPEC deal. In 2016, according to experts, the country had a downside risk for the oil market, as Libya tripled its oil production. However, damage to some of its export terminals means that production would be not more than1.25 million barrels per day. Analysts say that Libya represents a supply risk to the global oil market because of its ongoing political and economic instability.

Nigeria

Problems here are similar to Libya. It was also exempted from the OPEC supply cuts because it had high level of violence, instability and terrorism. In 2016, oil output was stable in Nigeria, hitting 1.2 million barrels per day. However, potential for further output gains is hardly possible as the country pledged to limit production when reaching the level of 1.8 million barrels per day. That was in 2017. Full-scale production is also affected by frequent terrorist attacks.

Venezuela

Experts are unanimous in the opinion that situation in Venezuela will worsen. This could spark a sharp decline in oil supplies. Without funding, state-owned PDVSA is not able to invest in new production and even maintain existing production. Experts suggest that Venezuela's oil quality has declined as it does not have funds to properly treat its heavy crude. At the same time, analysts do not rule out a possible debt default at PDVSA.

Български

Български

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română