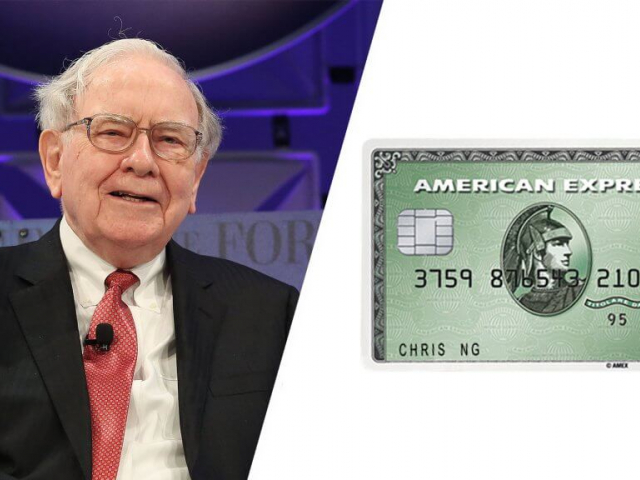

American Express

The first place goes to American Express, a company with a rich history and perfect reputation. The firm receives the lion’s share of its revenue thanks to its discount commissions. Sellers have to pay commissions for every transaction. All financial operations are performed via the Amex card. The company’s income rises along with higher prices of goods and services in the US. It is the third largest holding in Berkshire Hathaway, being just behind Apple and Bank of America. In the third quarter of 2021, revenue of American Express jumped by 25% to $10.9 billion. Today, Berkshire Hathaway holds 151.6 million company’s shares worth $24 billion. The price share is $170, whereas the dividend yield is 1%.

Coca-Cola

Coca-Cola is the second company whose shares seem profitable for Warren Buffett. It is a classical company resilient to recessions and inflationary pressure. The firm’s activity does not depend on the economic situation since its products are available for most people. It has been keeping its market position for a long time already. Coca-Cola’s price power is achieved by means of various marketing tools. For example, the company retains the price unchanged, using smaller bottles. Mr. Buffett’s investment portfolio contains 400 million Coca-Cola’s shares on the total sum of $23.1 billion. Today, the dividend yield of the company's shares is 2.8%.

Apple

A legendary IT giant, Apple, closes the list of top three promising companies according to Warren Buffett. The fact is that high prices of its products, including new smartphones, iPhone 13 Pro Max, do not discourage consumers. Apple’s products are always of high quality. Although its rivals offer cheaper devices, most people still prefer Apple Ecosystem. In other words, a consistently profitable consumer base protects the company from surging inflation. Its managers will hardly worry about a drop in sales. Apple is the largest publicly traded holding in Warren Buffett’s corporation. His investment portfolio contains 40% of the IT giant’s shares, which are constantly rising. In the last 5 years, Apple’s share skyrocketed by a stunning 500%. Today, the firm offers a dividend yield of 1.7%.

Български

Български

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română