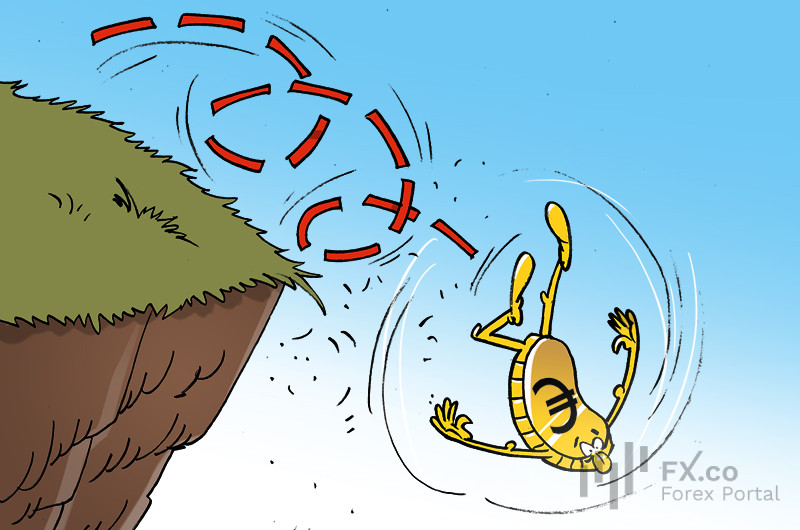

The euro is striving to maintain its position, yet there are growing concerns that it could experience a sharp decline. The European currency is once again forced to prove its significance amid a challenging environment. The dollar is overtaking it confidently as European Central Bank leaders signal that a rate cut in June is nearly inevitable, despite ongoing inflation issues. As a result, the euro finds itself trapped by these circumstances. A minority of central bank representatives are prepared to tighten monetary policy. However, the majority lean towards the opposite stance. François Villeroy de Galhau, head of the Bank of France, advocates for an immediate softening of monetary policy, stating, "We should not wait too long; we need to act now." Currently, France's budget deficit has exceeded expectations, reaching 5.5% of GDP. This is challenging to manage amidst high interest rates. Against this backdrop, analysts have revised their GDP forecast for France in 2024, increasing it from 4.4% to 5.1%. The European Central Bank (ECB) is facing calls for decisive action, yet remains indecisive. The regulator is caught between economic stagnation in Europe and high inflation, along with pressures from mounting debts, deficits, and a tightening stance by the Federal Reserve. This situation complicates the ECB’s ability to gauge the current level of policy firmness. The outlook for the euro remains pessimistic. While speculative long positions have decreased, the shift to short positions is not yet evident. Some analysts remain optimistic about the euro, but the majority highlight issues in its trajectory, increasing the likelihood of a further decline that could be significant.

Български

Български

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: