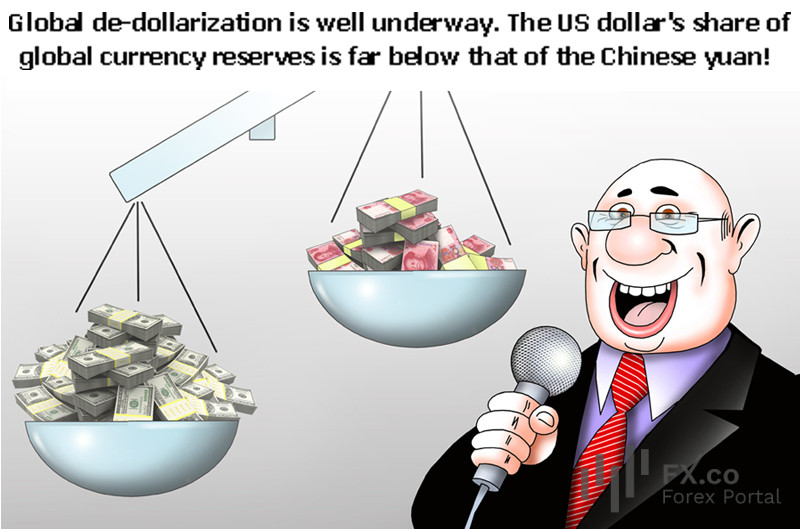

There have been numerous occasions when analysts proclaimed an end to the dollar’s dominance. However, the US currency remains the currency of choice for international trade. Apparently, the trend toward de-dollarization is greatly exaggerated.

In 2023, the US dollar’s share of global currency reserves rose slightly, while the Chinese yuan's share shrank, Business Insider reported.

Despite an increase in calls for a lessening of the greenback's status as the chief reserve currency and central banks’ efforts to reduce the use of the US currency in international trade and financial transactions, the dollar maintains its dominance on the world stage.

The share of US dollar reserves held by central banks increased to 58.4% last year, marking the first annual increase since 2015. In physical terms, USD holdings were up by $227 billion.

Although many central banks were attempting to diversify their reserves away from the US dollar and shift to the precious metal, the share of global central bank gold reserves remained virtually unchanged in 2023.

So, despite all the apocalyptic warnings and the growing de-dollarization trend, the dollar is still by far the dominant global reserve asset by a wide margin. At least, it is likely to remain so for a few more years.

Български

Български

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: