On the back of the unprecedented aggressive monetary tightening of the Federal Reserve, analysts sometimes unveil forecasts of a recession in the US. In practice, occasional dismal metrics cannot be treated as precursors to a full-blown recession. Indeed, some indicators warned of economic woes, but the US central bank was confident about a soft landing.

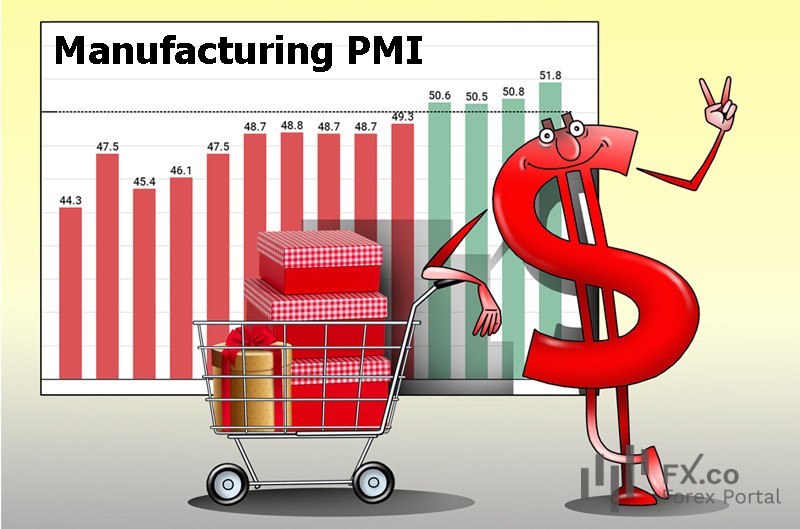

Experts at JPMorgan known for accurate predictions spotted the green shoots of a recovery in the manufacturing sector in September 2023. Their expectations have come true as the manufacturing PMI eventually climbed over the threshold mark of 50 points, separating expansion from contraction.

JPMorgan believes that a recession will no longer pose a threat to the US economy by 2025. They reckon that a revival in the manufacturing sector is a good omen for the broader economic recovery. US industry clicked into gear amid robust consumption that accounts for the lion’s share of national economic output. As consumers are willing to spend money, such buoyant demand will, in turn, boost domestic manufacturing.

Amazingly, the US economy has shown remarkable resilience in the face of stubborn inflation and extremely high borrowing costs. JPMorgan offers convincing arguments that the economic apocalypse is likely to be canceled.

Български

Български

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: