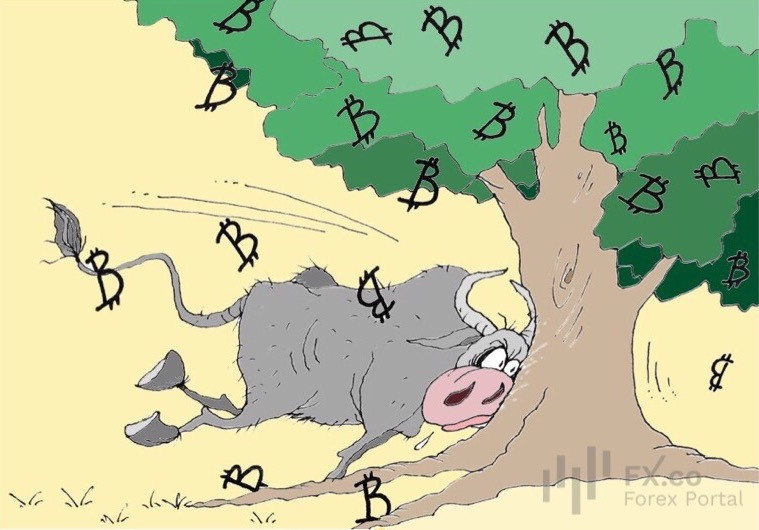

There are two types of companies in this world. Those who follow the path trampled by their predecessors, and those who blaze their trails through the jungle of unpredictability. MicroStrategy is clearly of the second type.

The company’s shares tripled to $1,919 from $632. MicroStrategy, managed by Michael Saylor, now stays above more than half of the companies in the S&P 500 index. In other words, it has outperformed 237 companies.

However, it is not just a fluke or luck. Michael and his team invested in BTC when it was not as trendy as it is now. Now, MicroStrategy, with a $32 billion market capitalization, looks down on many S&P 500 companies.

Nevertheless, the company is currently a constituent in the Russell 2000 Index, where members have an average market value of $1 billion.

Although “MicroStrategy can eclipse the valuations of even more S&P 500 firms, its inclusion in the index is hardly straightforward," Bloomberg writes. MicroStrategy “is essentially a leveraged holding company for Bitcoin,” Steve Sosnick, chief strategist at Interactive Brokers said. “And because of its unique structure, it doesn’t generate revenues and earnings in the sort of consistent manner that SPX listing criteria require.”

Български

Български

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: