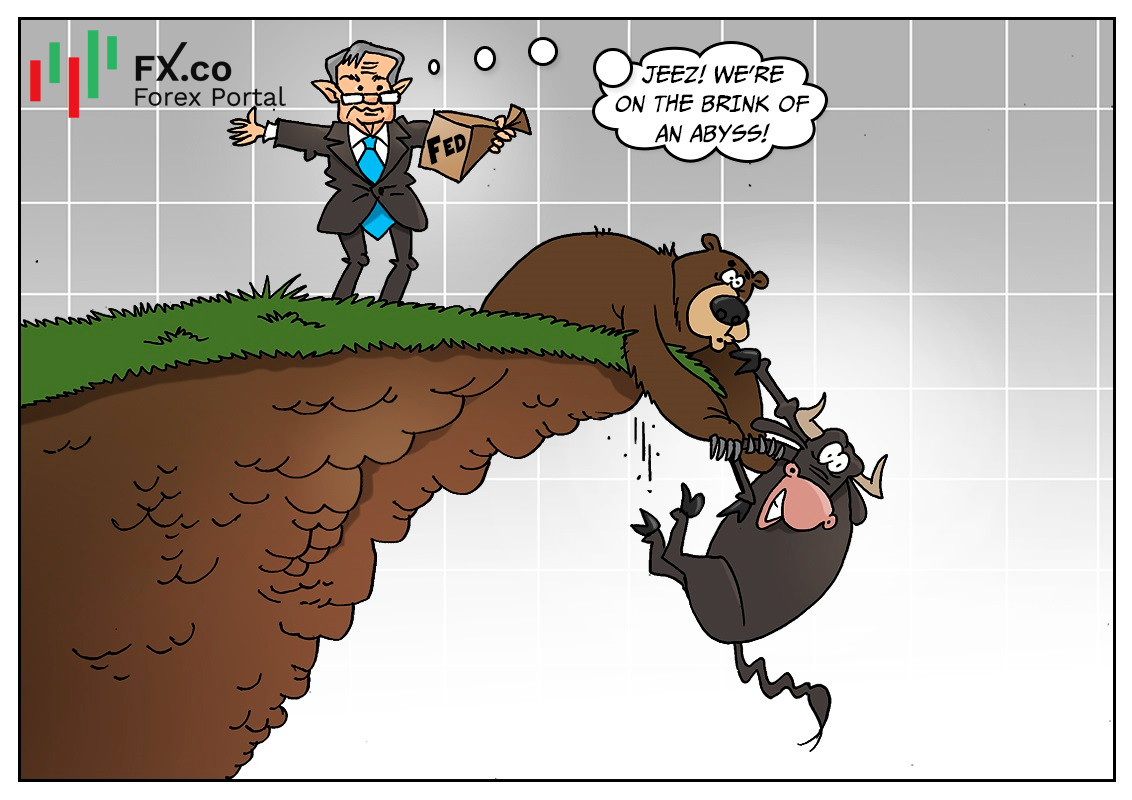

Deutsche Bank warns that the US economic problems may become graver next year. However, the United States will remain the world’s largest economy. A gradual rise in the key interest rate may spark a recession but it will hardly be a catastrophe.

For the last decade, the US economic collapse has been the most discussed topic in both Russia and other countries. The recent frightening forecast was published by Deutsche Bank. "The US economy is expected to take a major hit from the extra Fed tightening by late next year and early 2024," Folkerts-Landau and Hooper wrote in a report entitled "Over the Brink." The authors of the report are sure that the Fed will raise "rates by 50 basis points at each of its next three meetings on its way to a peak above 3.5% by the middle of next year". Notably, the Fed’s current target for the federal funds rate is 0.25%-0.5%. In addition, the US economy may face another threat, if the regulator reduces its balance sheet by approximately $2 trillion by the end of next year. This will have the same effect as three or four additional hikes of 25 basis points each. "Our call for a recession in the US next year is currently way out of consensus," Folkerts-Landau and Hooper acknowledged in their report. "We expect it will not be so for long," they added.

বাংলা

বাংলা

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: