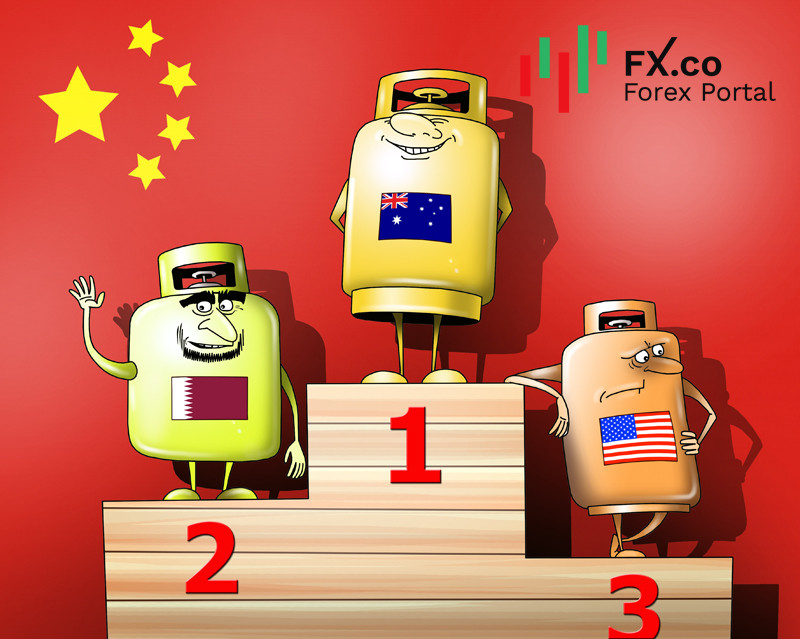

In November 2020, China ramped up imports of liquefied natural gas (LPG) from the two world’s leading suppliers, Qatar and the US. In turn, these exporters increased notably their supply rates that made them the second and the third largest LPG exporters to China.

China’s customs administration confirmed that Australia remains the key LPG supplier with the biggest delivery volumes. In November 2020 alone, Australia delivered the total 3.273 billion m3 of natural gas that is equivalent to 2.501 million tons of gas as a liquid. Nevertheless, Australia’s LPG exports in November were smaller than the ones shipped a month ago. This all points to a conclusion that China tends to buy less LPG from its long-standing commodity supplier.

At the same time, Qatar scaled up its LPG exports to the top Asian economy from 1.664 billion m3 in October 2020 to 1.878 billion m3 in November.

Besides, China is shifting focus towards the US. Thus, the US set a record in terms of its LPG exports to China at the end of 2020. In November, the US LPG shipments topped 1 million tons that was three times as big as the volume supplied in October. The US delivered 1.080 million tons of LPG which corresponds to 1.419 m3 of natural gas

Russia is ranked fourth among important LPG suppliers to China. Russia’s exports in November are measured as 869 million m3 that represents 10 standard lots. This volume is just 3% less than the record level logged in September 2020. Moreover, Russia boosted 5 times its LPG exports to China in November 2020 in annual terms.

All in all, China purchased the record high volume of LPG in November 2020. It totals 7.59 million tons of the liquid fuel, equivalent to 9.974 billion m3 of natural gas. Hence, China’s LPG imports ballooned 18% on a yearly basis. Remarkably, China’s LPG imports set a historic record in October 2020.

Importantly, rising rates of LPG consumption by large Asia-Pacific countries signal crucial changes in the global energy market. The corona crisis slashed LPG shipments as energy consumption by Asian countries reduced notably for the most part of the last year. Meanwhile, the global economy is gradually getting back on track. So, Asia-Pacific countries are reviving their demand for various kinds of fuel. It means that LPG could surge in value in the near time. Market quotes of LPG traded on European exchange floors have climbed 45%, thus curbing the LPG glut in the global market.

বাংলা

বাংলা

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română