Today, on the back of rising US Treasury yields, the price of gold is falling. Yesterday, on Wednesday, Federal Reserve Chairman Jerome Powell said that inflation is too high and progress in taming it is dubious. For this reason, the Federal Reserve will keep interest rates high longer than expected. Therefore, such prospects undermine demand for the non-yielding yellow metal and increase US Treasury yields.

Besides, the generally positive risk appetite is seen as another factor putting downward pressure on the price of the precious metal. At the same time, the US dollar is trying to attract buyers. But with Powell downplaying the risk of further interest rate hikes, XAU/USD could find some support ahead of Friday's closely watched US nonfarm payrolls report. The NFPs could limit the decline in gold prices.

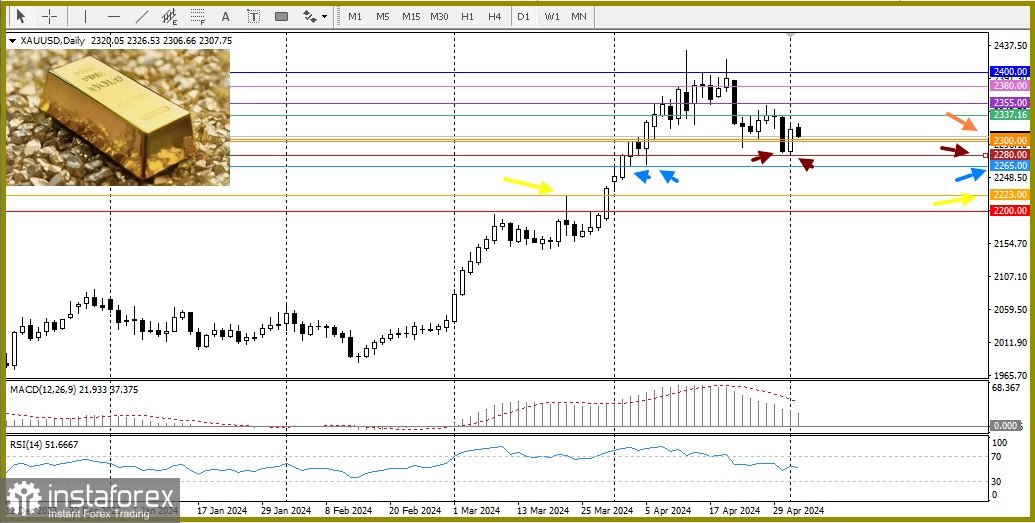

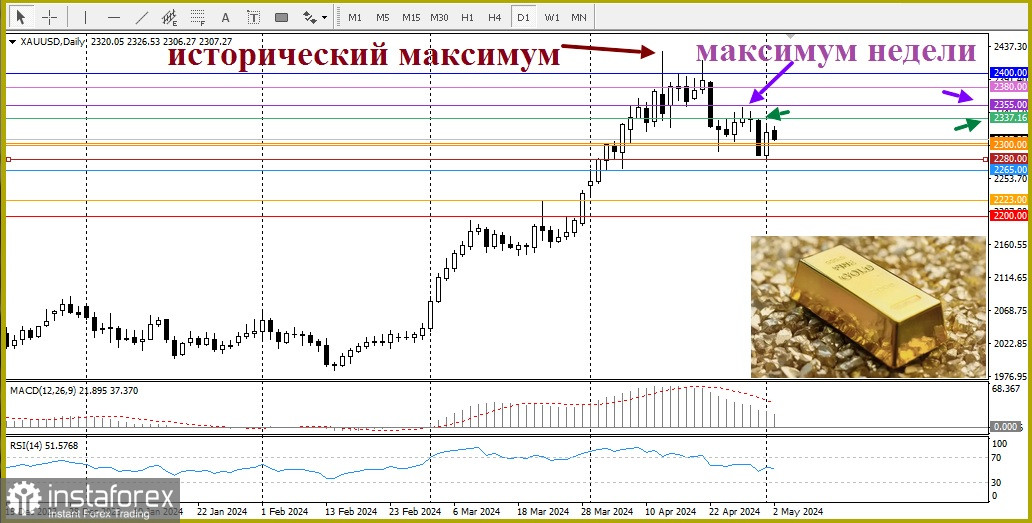

From a technical viewpoint, with a fall below $2,300, the instrument will find decent support near the $2,280 level. If this level is decisively broken, the path to deeper losses will open. Gold prices will then accelerate their decline towards the next relevant support at $2,265 on the way to $2,223 and $2,200.

On the downside, the immediate hurdle is the supply zone at $2,337 ahead of the weekly high near the $2,355 area. Sustained strength could lift the gold price higher, on the way to the round $2,400 level and the all-time high near the $2,431-2,432 area reached on April 12.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română